Global Companies Invest in Drones Despite Recession

Companies continued to invest in drone technology in 2020. This is in spite of the global recession caused by lockdowns and the pandemic. We recently wrote about companies’ development over the past year, and there were also plenty of investments and partnerships. Here is a glimpse into how companies continued to invest in drones throughout the world.

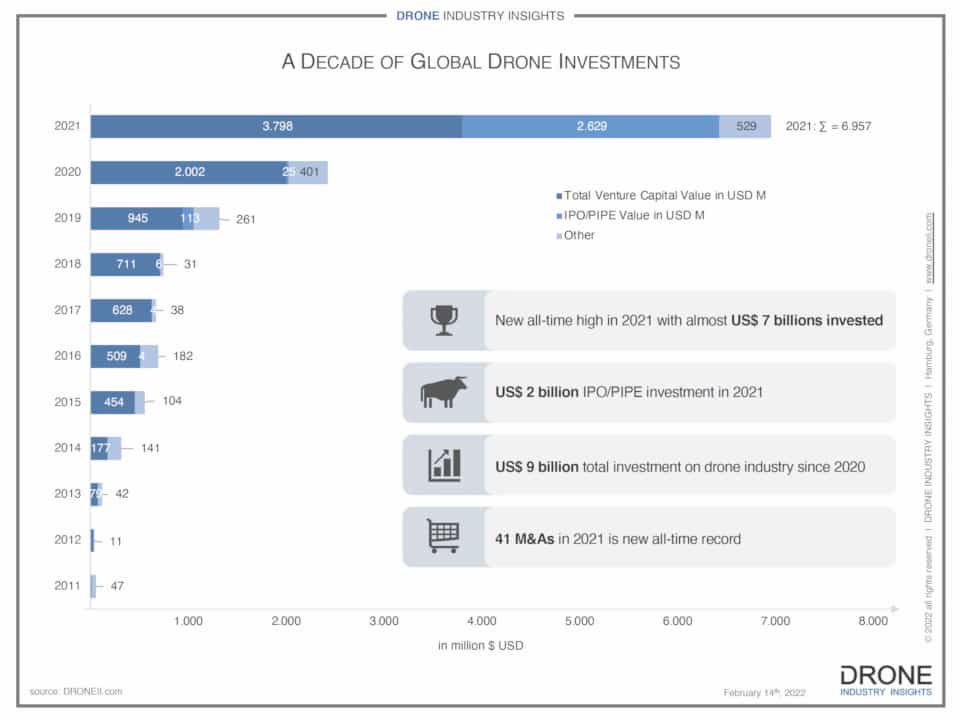

Investing in Drones Breaks Records

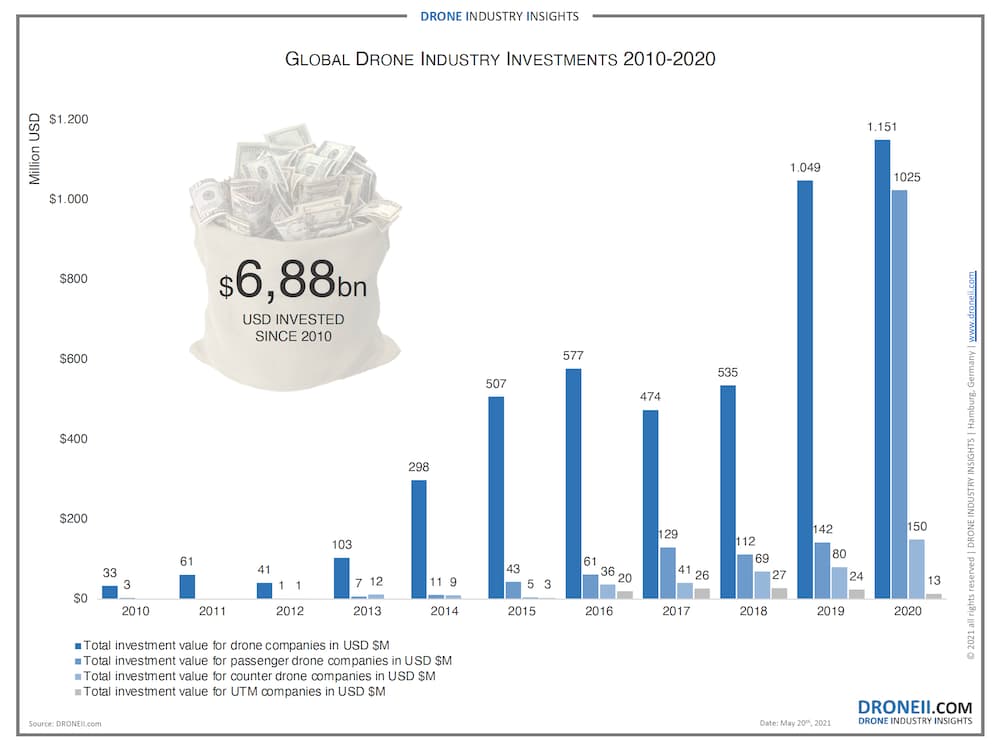

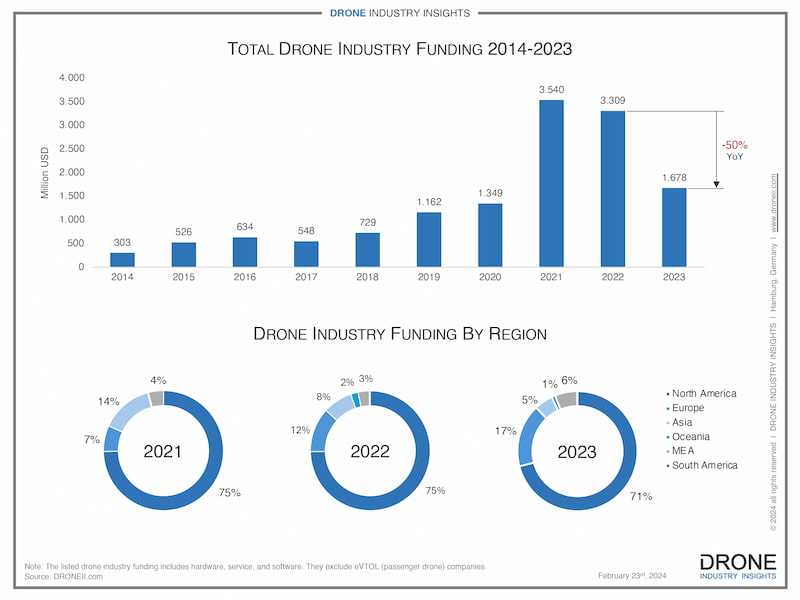

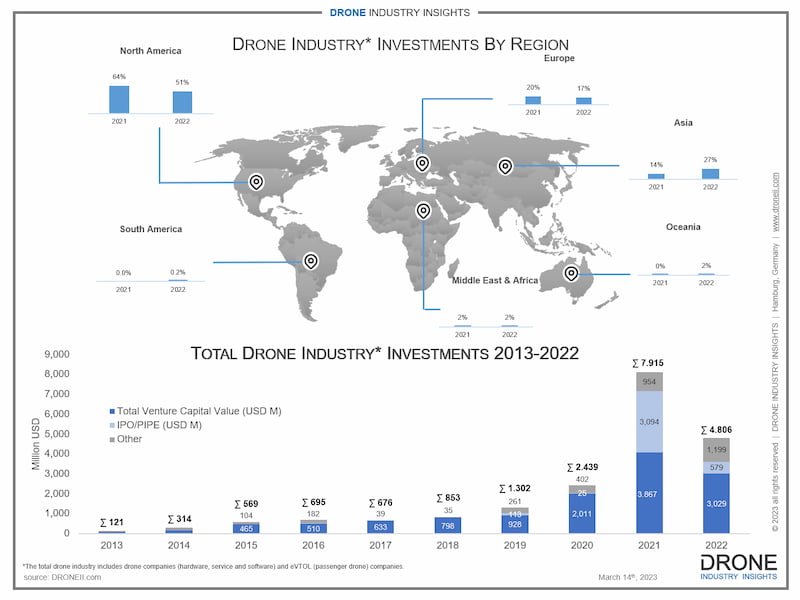

The amount of money going into the drone industry reached new record in 2020 with US$2.338 billion (US notation). This practically doubles the amount from the previous year (US$1.295 billion) which had already been a record in itself. Our investment database shows all the investment rounds from all players, but here are the key takeaways per segment and sector.

The hardware segment exploded and reached US$2 billion. This is a substantial increase compared to last year, where the services segment was almost equal and the gap with hardware was only US$159M rather than the current gap of US$1,900M. This means investment grew in drone companies that produce hardware, and one particular reason for this are forward-looking products such as passenger drones, which we will elaborate more on shortly. Regarding the other two sectors, both services and software experienced a decrease in drone investments. But it is worth keeping in mind that a decrease in drone investments doesn’t mean a decrease in their quality or profitability. Indeed, we previously highlighted that software companies grew in size by 20% during the pandemic year, which makes it likely that they increased their revenue and relied less on drone investors.

In terms of sectors, it was a record year for investing in drones, passenger drones and counter-drone technology. As we mentioned in our company growth blog post, passenger drone manufacturers grew particularly strongly despite the pandemic, and in fact these received the second highest amount of investments (US$1.025B). Overall, the majority of those who invest in drones continue to put their money on general drone companies (providing all hardware, software and services but excluding passenger and UTM companies). Counter-drone companies were able to rehab a little with US$150 million after the drought year of 2019 that brought in only US$80 million in total. Meanwhile, UTM companies lost a little attention compared to earlier years with just US$13 million.

More Regions Invest in Drones

North America continues to be the dominant region for investing in drones with 62% of investment value across the world. This is, however, a decrease from last year’s share of 71% of drone investments, which means that other regions are receiving more investments. The region that gained the most ground in this regard was Europe, which gained 8% from its share of the value. Nevertheless, the other regions such as Asia, Middle East and South America also gained share from the overall investment value. The only region to lose ground was Oceania.

Focusing more specifically on countries for drone investments and on the number of deals rather than the value of these deals, the USA continues to be the country with 33% of drone investors focusing on companies in the United States. The next top country in 2020 was Germany with 9.6% of drone investment deals that represented 14.1% of total value. Rounding off the top 5 are Israel, Japan and China, which fits well with the general pattern of the past decade. From 2010 to 2020, the top countries to invest in drones (in terms of value) have been the USA, China, Germany, Israel, and Canada.

Want more investment data? Check out our Investment & Partnership Databases!

Database | Drone Market Investments & Partnerships

• Listing of 1,100+ investments around the world since 2010 including region and country

• Listing of 750+ partnerships since 2015, including both partners’ regions

• Breakdown by segment (hardware, software, services), sector (drone company, passenger drone, counter-drone, UTM), deal type (seed, early-stage, post-IPO, M&A, etc), and series (A, B, C, D), as well as inter-segment partnerships, and cross-industry partnerships

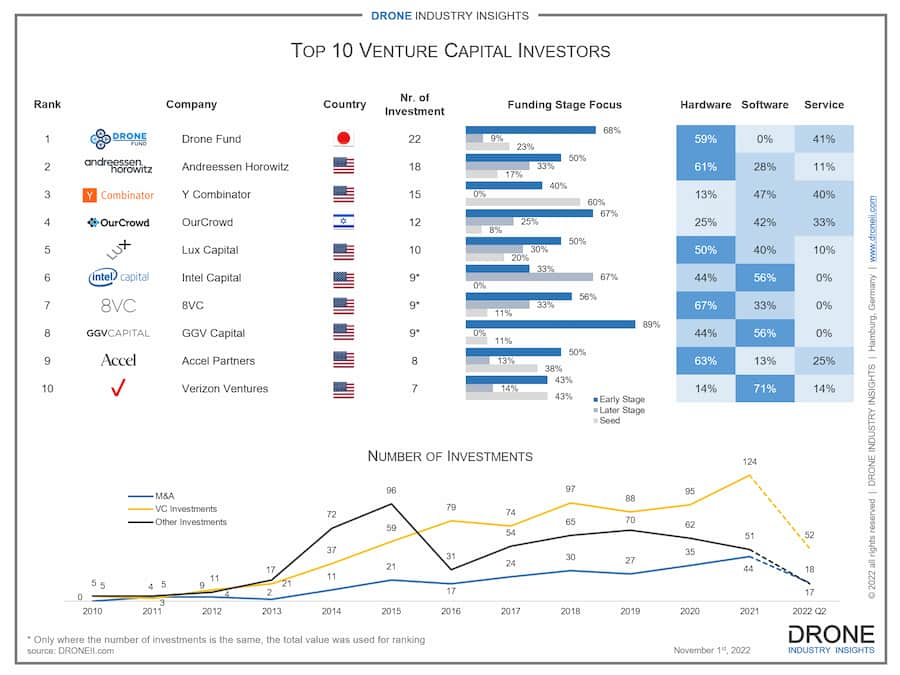

Other Drone Investors: Mergers, Acquisitions and IPOs

Aside from putting money into companies, other types of investments are mergers and acquisitions (M&As), where the new standard seems to be 30. In both 2019 and 2020, there were more than 30 M&As. The type of companies that were acquired the most fell under the software segment, followed by hardware. It is a good sign for the market that the number did not dramatically increase or decrease from one year to another given the pandemic. This serves as another good sign of a drone market that is becoming more mature and less volatile, which is encouraging for anyone looking to invest in drones.

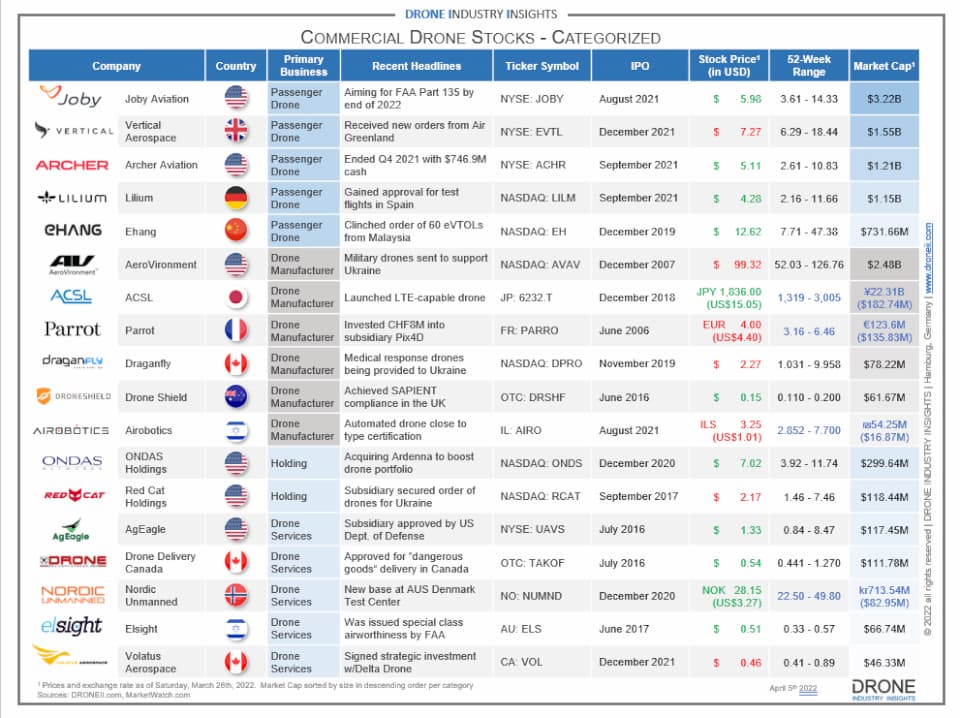

Interestingly, volatility and unpredictability were more of a factor in financial markets throughout the world, which is one reason why there were not a lot of initial public offerings (IPOs). The only note-worthy IPO to take place in 2020 was Nordic Unmanned, which is now listed in the Euronext Growth market under ticker symbol NUMND. And this leads us to one final observation about drone investments and the transition between 2020 and 2021: companies becoming publicly traded.

Joby Aviation and Lilium acquired the largest investments throughout the drone industry in 2020. Joby had two investments, including its acquisition of UBER Elevate through M&A, for a total of US$590 million. Meanwhile, Lilium also had two rounds in 2020 for a total of US$240 million. Both of these operate in the passenger drone sector which received the most investments in 2020, and both announced in early 2021 that they would go public via SPAC deals. Some have argued that using a SPAC over an IPO can be more advantageous in a volatile market, such as the one we experienced in 2020. So it will be interesting to see if and how this trend continues through 2021 and beyond.

Why Companies Invest in Drones

In conclusion, the data shows that drone investments continue to increase despite the devastating economic effects of the COVID19 pandemic. Many industries struggled and experienced layoffs. However, many also saw this as an opportunity to invest in the drone ecosystem and drone companies grew while the overall level of investing in drones almost doubled. This is likely because of the high potential that drone technology brings to revolutionize business. Drones can optimize and, when necessary, substitute the work of humans, which is why they have taken off in all industries.

As the effects of the pandemic fade, many businesses will seek to return toward regular operations. Yet other companies will likely be operating with newer drone technologies that received a boost while others were locked down. The large investments in drones have provided a substantial push to an already-rapidly-growing drone industry. In particular the heavy investment into drone hardware mean that we are likely to see drones being used more and more as regulations catch up. And the record investment into passenger drones means that perhaps we will indeed be flying around in drones by 2024.

Download our FREE Companies Invest in Drones 2010-2020 Infographic

This infographic, “Companies Invest in Drones 2010-2020”, which shows investments in drone companies since 2010

Before working with drones, Ed acquired vast experience in Communications and Diplomacy. He holds a Master’s in International Relations, Bachelor’s in Economics & Philosophy, and has lived in 7 countries.

Before working with drones, Ed acquired vast experience in Communications and Diplomacy. He holds a Master’s in International Relations, Bachelor’s in Economics & Philosophy, and has lived in 7 countries.