Drone Industry Investments in 2022: Less Records, Same Growth

Over the past few years, we reported that drone industry investments have been progressively reaching new heights and breaking records. However, the year 2022 finally saw an end to the exponential growth, and the total value of investments decreased by 39% compared to the previous year. Nevertheless, the investments going into the global drone industry still reached over US$4.8 billion. This means that the decrease in growth does not mean that there was a shrinkage or loss of drone industry investment in any way. As complement to our latest Drone Industry Investment Database, here is a glimpse into the latest data about the drone industry and its investments.

Snapshot of Drone Industry Investments

According to our research, we registered 179 investment deals in the drone industry in 2022, which amounted to US $4.8 billion. A closer look at the timing of these drone industry investments shows that the total number of investments started to decrease in May 2022. This was a couple months after the Russian invasion of Ukraine and the reporting of small recreational and commercial drones being used in warfare. After several months, the numbers picked back up in November, when total drone industry investments reached their maximum level. Interestingly, both the decrease in May and the increase in November came after major headlines regarding DJI [in April and October], but to show any sort of causal relationship between these events would require a more in-depth study.

Meanwhile, Mergers and Acquisitions (M&A) also saw a slight decrease in 2022, with 40 deals compared to the previous year’s 47 deals. This decrease is rather insignificant, especially in comparison to the number of partnerships that grew massively, with 270 deals in 2022 vs the 193 deals in 2021. The majority of these partnerships (74%) were between drone companies and non-drone companies, which once again is a strong sign of how drone technology can support work activities and operations in many other industries. In other words, the drone world isn’t a closed ecosystem of drone companies working only with each other, but rather a multi-industry of companies working to achieve their goals more efficiently.

Drone Industry Investment Trends by Region and Company Type

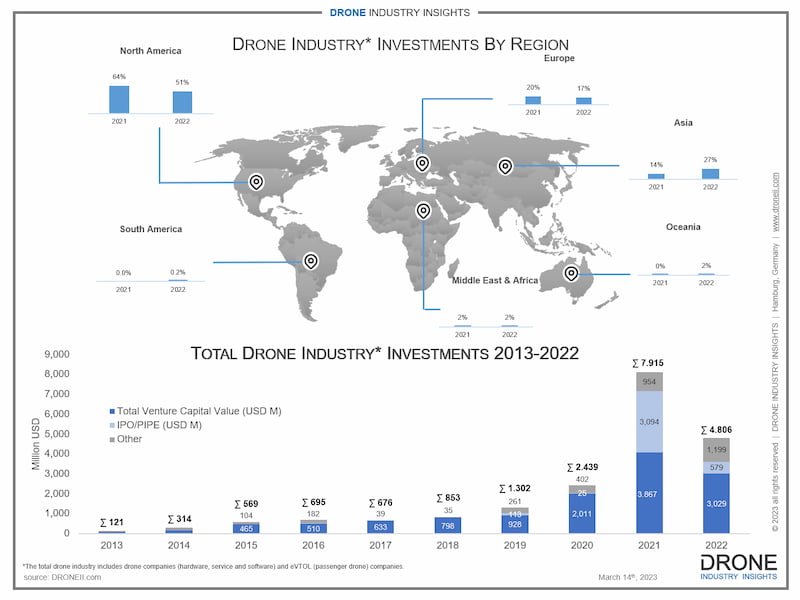

In terms of regions that attracted the most investment, North America was once again at the top, but it was much less dominant than in previous years. In 2021, North America represented 64% of the total investment value going into drones, while in 2022 this figure was a much lower 51%. Meanwhile, the number two and three regions swapped places from the previous year: Asia rose from 14% of investments in 2021 to 27% in 2022 and overtook Europe, who fell from 20% to 17% in 2022. All things considered, the top three regions continue to dominate drone industry investments by taking up 95% of all investment value.

Regarding the company type, there were also similar patterns. Much like in previous years, a significant percentage of the total investment was allocated to hardware drone companies, which accounted for 84% of the total investment. However, this year, software drone companies received US$534 million, which was more than double the investments received by drone service companies (US$210 million).

Investment Types and AAM Industry Investments

Regarding the deal type, 37% of investments in 2022 were in the early stage of venture capital. This year, companies received more bank credit, resulting in a 24% increase in the “Debt” deal type. However, there were not many IPO/PIPEs this year compared to the previous year, where a lot of eVTOL (electric Vertical Takeoff and Landing) companies entered stock markets through these deals. And this leads us precisely to one particular growing sector of the drone industry.

Taking a closer look at the Advanced Air Mobility (AAM) investments, eVTOL hardware companies received considerably higher investments (US$3.1 billion) compared to two other AAM categories in 2022. These other two trailing categories are Cargo Hardware (US$52 million) and Delivery Service companies (US$67 million).

From an individual funder perspective, the US remains the leading nation and accounts for the most investors in 2022 (~40%). However, the overwhelming status is slightly declining, while countries from Northern Europe, the Middle East and especially India (10%) could increase.

Want to Know More About Drone Industry Investments in 2022 and Beyond? Check Out Our Latest Drone Investment Database!

Drone Investments Database 2023

• 27-page Summary + 2 Databases (Investments and Partnerships)

• List of 1,600+ investments around the world since 2010 by region & country

• Drone stock performance for drone stocks throughout all of 2022

• Listing of 1,200+ partnerships since 2015, including both partners’ regions

Introducing: Drone Stock Performance

For the first time, this year we added a drone stock section to our drone industry investment summary. In this section, we look at the performance of publicly traded drone companies through all of 2022. To make sense of how they performed, we compare the market capitalization of drone companies at the beginning and end of 2022. By and large, the market cap of most drone companies declined regardless of market sector, but some companies like AeroVironment, Parrot, and Primoco UAV (who had the biggest change) recorded a net increase in their market cap from beginning to the end of 2022. With key regulations taking effect in both Europe and the US, it will be interesting to see if stock prices pick up along with advanced operations in 2023.

Conclusion: Drone Industry Investments in 2022

Despite a lower level of total value in drone industry investments, the drone industry continued to attract investors in various ways throughout 2022. The AAM sector saw considerable investment in eVTOL hardware companies; partnerships between drone and non-drone companies saw an increase in 2022; and the overall value in global drone industry investments was still a whopping US$4.8 billion (higher than 2018-2020 combined). So a year-to-year decrease is far from a reason to worry or sound the alarm about the attractiveness of investing in drone technology. The record-breaking path may be over, yet the healthy growth of the drone industry through investments continues, and will likely remain that way in the coming years.

Download our FREE Drone Industry Investments in 2022 Infographic

This infographic, “Drone Industry Investments in 2022”, shows the top regions that received drone investments in 2022 as well as the value of drone investments over the past decade.

Besides his financial oversight, Hendrik is an expert in aviation law and UAV regulation with more than 10 years of experience. Not only does he consult on all regulation questions, but Hendrik also writes the yearly drone investments report. Prior to launching DRONEII, at Lufthansa Technik he was the single point of contact to Civil Aviation Authorities (CAA) of Germany, Middle East and Asia.

- 1 Snapshot of Drone Industry Investments

- 2 Drone Industry Investment Trends by Region and Company Type

- 3 Investment Types and AAM Industry Investments

- 4 Want to Know More About Drone Industry Investments in 2022 and Beyond? Check Out Our Latest Drone Investment Database!

- 5 Introducing: Drone Stock Performance

- 6 Conclusion: Drone Industry Investments in 2022