24 min read · Created: 2017-08-30 · By Hendrik Boedecker

Drone Partnerships Gone Wild

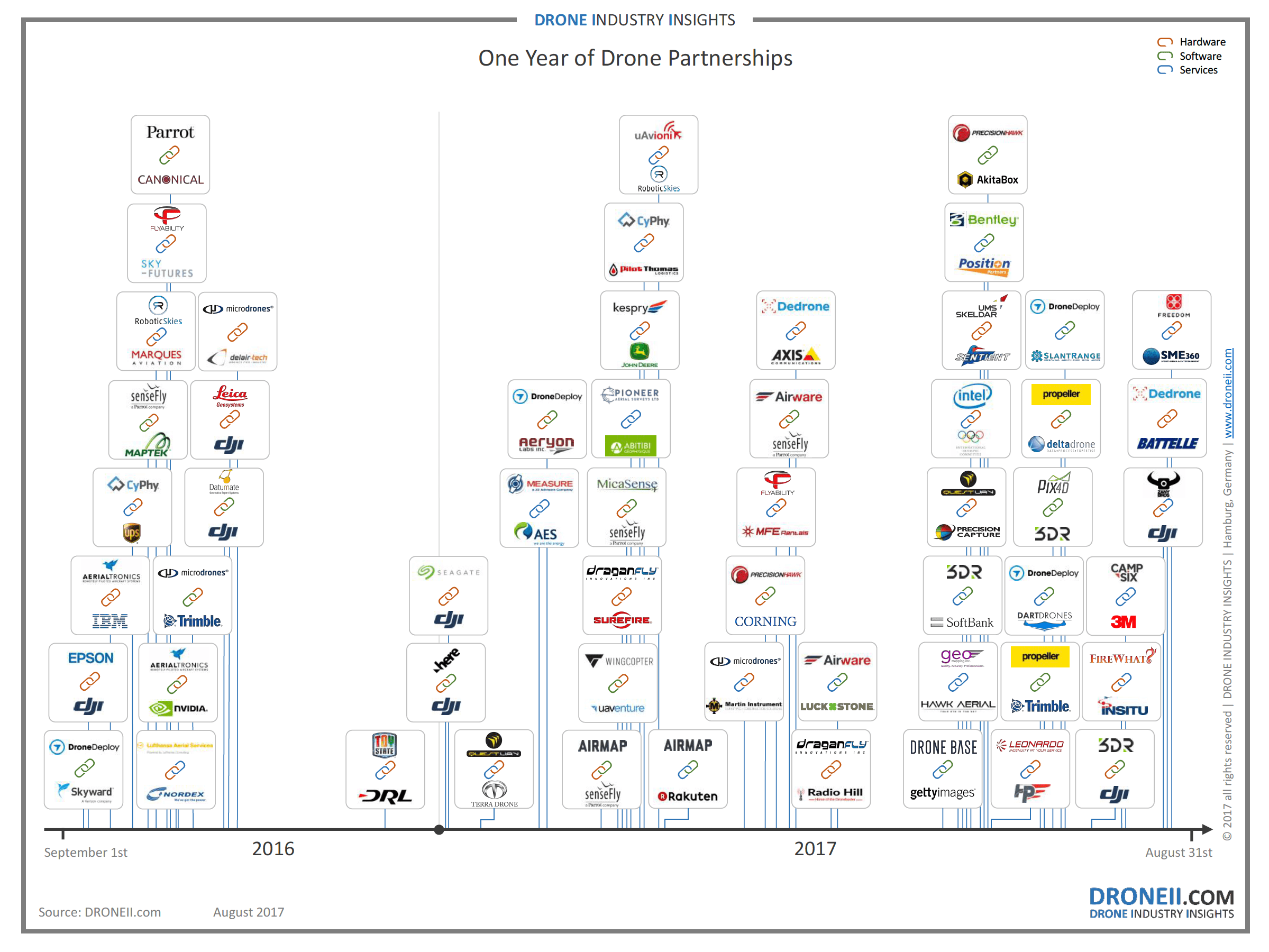

The last year in the drone industry moved at incredible pace – especially when it comes to strategic partnerships. We frequently provided updates about drone partnerships in the past. Now, why is this so important? Drone companies (hardware and software manufacturers, and service providers) are constantly expanding their product/service portfolio and interdisciplinary expertise. This is extremely interesting because it unveils the company’s strategic alignment.

Looking at the last year, the number of strategic partnerships increased by 24% (42 to 55) compared to the same period of the previous year which shows the increasing maturity of the industry. Furthermore, the elements changed: partnerships with software companies (2016: 20% -> 2017: 33%) and services (2016: 29% -> 2017: 31%) increased. The role of hardware is still very important (2016: 51% -> 2017: 36%), but the industry understood that it cannot stand alone anymore – customers look for easy-to-use end-to-end solutions and this involves software and service.

What happened so far

There are very active players like DJI, Intel, Parrot, DroneDeploy, Airware, Airmap and 3DR in the drone industry tirelessly building their individual end-to-end ecosystem. Strategic partnerships, however, are not just there to build a solution but also to detain key-players from competitors. So far it seems there are plenty of fish in the sea but the fight for key-technologies and key-players has already begun some time ago.

Hardware + Hardware

To continuously enlarge the product portfolio and product abilities, HW+HW partnerships are a good way to complete a solution. Yet, these kinds of partnerships are still the minority. Again, this indicates the already high maturity level of the drone technology.

- Microdrones and Delair-Tech partnered to combine R&D strengths, allowing Delair-Tech and Microdrones to collaborate on “the second generation of commercial UAVs”.

- UMS Skeldar and Sentient Vision Systems announced an agreement to provide the ViDAR (Visual Identification Detection and Ranging) system for USM Skeldar’s unmanned systems at the Paris Airshow.

- Dedrone and Battelle will explore ways to create an end-to-end solution (detect and defeat drones) to provide complete airspace security for sensitive infrastructures.

Hardware + Software

The strategic HW+SW coalitions represent the biggest block in the overall comparison, exemplifying the rising value of data driven end-to-end solutions. Hardware manufacturers are currently under extreme pressure and software partnerships are the biggest opportunity to reach the actual clients’ needs: actionable data.

- Flyability and SkyFutures have partnered up to launch a fully integrated solution for drone-based industrial inspection, merging the critical infrastructure platform (Elios) with inspection software.

- DroneDeploy and Aeryon Labs teamed up to enable operators capturing imagery using the Aeryon SkyRanger UAV and process it into maps and 3D models on the DroneDeploy platform.

- 3DR and DJI announced that 3DR’s “Site Scan” software will now work on DJI drones, starting with the Phantom 4 and eventually expanding from there to support other drones in DJI’s product line.

Hardware + Service

HW+SV is a strong combination and often used as an additional sales channel, or to offer a true end-to-end solution. Drone acquired data must be translated into actions. So why not add value through a partner experienced in data uploads to machinery? The following are a few examples of this strategic partnership:

- John Deere will offer their customers the Kespry aerial intelligence systems. The deal could prove a boon for sales of Kespry’s drones and data analytics software. It could help John Deere tap into new, high-tech means of generating sales and profits in construction and forestry.

- Flyability’s and MFE Rentals’ partnership enables the Swiss-based drone manufacturer to accelerate the use of the Elios in North America.

- Freedom Class and SME360 partnered to manage and promote the newly sanctioned FAI Freedom Class and Freedom 500 Drone Racing series globally.

Software + Software

There are a lot of industry-specific software solutions available today. Yet, these niche products need extensions, exposure, and multifunctionality to successfully make their way into industrial applications. Strategic SW+SW partnerships provide a tremendous competitive advantage. Remember: software eats the word!

- DroneDeploy and Skyward: the two companies will collaborate on an integrated approach that relieves compliance pain and streamlines overall drone operations.

- PrecisionHawk and AkitaBox partnered to capture data and automatically generate a 3D point cloud, 2D orthographic views, and 3D mesh data models that can be fed into AkitaBox for further analysis and long-term planning.

- 3DR’s Site Scan software and Pix4D’s leading photogrammetry engine offers an industry first: multi-engine photogrammetry processing for aerial data products.

Software + Service

Software as a service business models have revolutionized the world, and SW+SV sales partnerships can supply additional leverage on these models. Service providers on the other hand often require a niche software solution to launch a new business branch, as our first example shows:

- Airmap and Rakuten’s UTM platform will provide situational awareness for airspace managers. Rakuten entered the commercial drone field with the launch of the Sora Raku, a drone delivery service in April 2016.

- Airware and Luck Stone partnered to expand UAV data collection processes. Airware’s technology improves operational efficiency with its powerful analytics tools, which were developed specifically for the mining and aggregate industry.

- DroneBase and Getty Images, a global leader in visual communication, signed a worldwide content distribution deal with the leading global drone pilot platform DroneBase. The agreement allows the supply of high-quality 4K videos to over one million customers.

Service + Service

A partnership between SV+SV providers is a promise for something big. Presuming that both providers already possess the required hardware, software, and sales channels it represents the most comprehensive (“buy”) offer from a customer’s point of view.

- Measure and energy provider AES partnered, allowing AES to ramp up the use of drones and to get more and state of the art drones on short notice, along with pilots to help run them wherever they are needed.

- Geo Wing and Hawk Aerial now extend the range of services, sensors, and platforms and provide each partner with the ability to offer their clients superior survey and map products.

- Camp Six Labs and 3M’s strategic collaboration will help wind-turbine owners achieve optimal performance and return on investment using 3M’s wind products, while simultaneously leveraging on installation efficiencies provided by Camp Six applicators.

What happens next

The degree of drone hardware and software maturity is high, but the challenge lies in the integration into existing services and business models. Larger players will play an increasingly important role and make drone technology an essential part of their product/service line. Since competition will become much fiercer in the near future product portfolios based on strategic partnerships will have a great advantage, while the competitive pressure on the lone wolfs will rise.

According to Gartner’s Hype Cycle, we are on our way to the valley of disillusionment. This does not mean that the market will slow down or shrink – it means, the industries realize that there is more to the successful adaptation of drone technology than was assumed a year ago.

Strategic partnerships often lead to mergers or acquisitions which will further drive the market consolidation over the next years. Once the market is sorted and the “plateau of productivity” is reached (in 2-5 short years from now), the number of partnerships will decline. Deal sizes for mergers and acquisitions, however, will increase dramatically.