-

- The Drone Supply Chain at a Crossroads

- The Structure of the Drone Supply Chain

- The Security Dilemma and Geopolitical Pressures

- The US Tariff Shock

- Supply Chain Vulnerabilities: Europe and North America

- The Push for Localization and Diversification

- How much is Supply Chain Sovereignty worth?

- Short, Resilient, Affordable, Yesterday

Global Drone Supply Chain Disrupted: Crisis & Opportunity

The Drone Supply Chain at a Crossroads

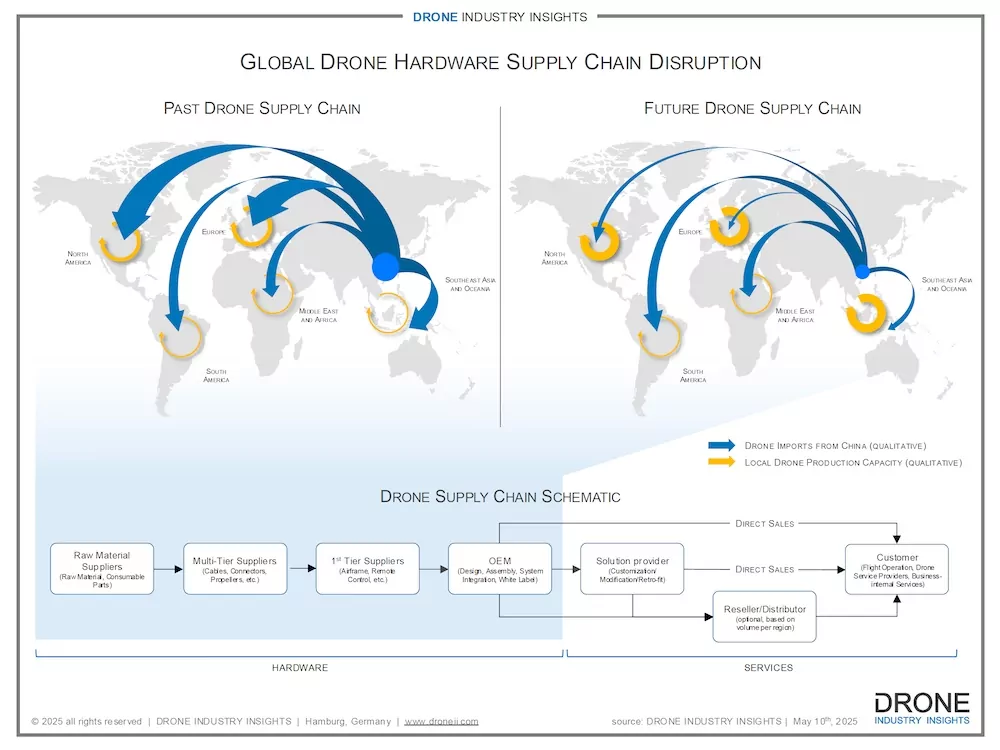

For years, Chinese manufacturers have dominated the production of critical drone components, positioning China as the backbone of the industry’s supply chain. However, escalating geopolitical tensions, new tariffs, and security concerns have forced stakeholders across North America, Europe, and beyond to rethink their sourcing strategies. This article analyzes the major trends, challenges, and emerging solutions shaping the future of the global drone supply chain.

The Structure of the Drone Supply Chain

Most commercial and industrial drones rely on a handful of critical components, many of which are (almost exclusively) produced in China. These include motors and ESCs, Lithium-ion batteries, flight controllers, sensors, cameras, propellers, and structural parts like carbon fiber tubes and frames.

Chinese firms have capitalized on state subsidies, scalability, and technological expertise to offer these components at globally competitive prices. Consequently, even leading Western drone manufacturers source critical elements from China, making them heavily reliant on Chinese manufacturing. Although these supply chains benefit from efficiencies through economies of scale, they remain vulnerable to geopolitical shifts.

The Security Dilemma and Geopolitical Pressures

Growing national security and data privacy concerns have increased regulatory scrutiny in the US and Europe. Following the initiation of the American Security Drone Act in 2019, the use of drones within government organizations has expanded. The US government, has blacklisted several Chinese drone and component manufacturers, banned federal agencies from using certain Chinese drones, and is currently seeking public input on new regulations to secure the drone supply chain. In Europe, the situation is similar, with governments tightening procurement rules and adding more Chinese suppliers to sanction lists.

China has responded by imposing export controls on critical drone technologies, further complicating global supply chains. The country’s commerce ministry announced on April 5, 2025, that China has added 11 US firms to its unreliable entity list. According to the statement, China “[…] holds the 11 firms accountable for unlawful activities, in accordance with relevant laws and regulations. […]” This tit-for-tat dynamic has made sourcing reliable, sanctioned-free components increasingly complex, if not nearly impossible.

Global Drone Market Report 2025-2030

- Extensive 230-page drone market report with in-depth analysis, industry definitions, & extended 5-year forecast.

- Breakdown of the market by industry recreational & commercial

- Breakdown of the market by industry segment (hardware, software, services)

- Breakdown of the market by application method

- Breakdown of the market by unit sales

- Breakdown of the market by region and country

The US Tariff Shock

The most disruptive recent development is the imposition of steep new tariffs on Chinese drone imports. As of April 2025, the US has enacted a combined 170% import duty on most Chinese drones and components, marking a dramatic escalation from previous years. These tariffs have sent shockwaves through the drone supply chain, with a financial burden cascading from importers to manufacturers, service providers, and end users.

The Trump administration’s idea for US drone companies is to source locally manufactured components, leading to two problems: 1. Those locally sourced components are much more expensive, making the final product too costly to be competitive, or 2. No local production capacity is available at all, bringing the entire enterprise to a halt.

As these tariffs have now been suspended for 90 days, the worst seems to be over – on the other hand, this shows the unpredictability of this instrument under the current US administration.

Supply Chain Vulnerabilities: Europe and North America

The heavy reliance on China exposes Western stakeholders to several risks. Export controls and sanctions can halt the flow of key components overnight, causing supply disruptions.

The lack of capacity to produce certain key components creates a strong limitation in autonomy. Since Chinese subsidies keep prices low, it makes it hard for local suppliers to compete on cost, creating a substantial competitive disadvantage.

A case in point is Ukraine’s drone program. Despite efforts to localize the drone production, most of its imports in early 2024 came from China, and even “localized” drones still rely on China-made components.

Another vulnerability is that even if the US lifts the current tariffs, China could keep the reciprocal tariffs up longer, putting the US in a weak position.

The Push for Localization and Diversification

In response to geopolitical pressures and tariffs, manufacturers and governments are taking several steps to mitigate the risk. The most crucial step is to relocate production. Already, some brands are shifting manufacturing to Vietnam, India, or Mexico to sidestep Chinese sourcing and tariffs.

Others focus on “nearshoring” by creating local or even national supply chains. This might not be possible everywhere, but some players in Europe and the US only source local hardware and software. If no local supplier is available, another, however very expensive, option is to vertically integrate production by building up local capacity yourself from scratch.

These changes in world trade don’t go unnoticed, as both the US and EU are investing in domestic manufacturing, R&D, and supply chain resilience. For governmental drone use, the Blue UAS Framework published a list of “Interoperable, NDAA-compliant UAS components and software” to help drone makers and operators source locally.

During the Cold War, in the 1980s, the US wanted to become independent from Japanese semiconductors, heavily investing in local production capabilities. This effort took almost 10 years, and the result was that the US could catch up technologically and somewhat stabilize the local semiconductor supply. However, the products were more expensive than Asian ones, and the US never fully became independent from other countries.

Despite all efforts, establishing a robust local drone supply chain is a long-term undertaking. Europe and North America must invest significantly in the mass production of batteries, electronics, and materials science to reduce their dependency on China. Promptly!

How much is Supply Chain Sovereignty worth?

The potential of drone technology is more than evident today, not just in conflict areas, but what would it mean to switch to local production?

First and foremost, we’ll see delayed innovation. While the technology exists (somewhere else), reinventing the wheel will take a long time. In a disruptive and fast-moving market like the drone market, this could mean a loss of pace that cannot be made up for.

While affordable drones lead to stronger industry adoption, locally manufactured and expensive drones will affect the adoption speed, resulting in a loss of market relevance.

New local partnerships will be needed, which takes a lot of time and effort, occupying the company’s capacities. New system architectures will be required, leading to compatibility problems. Additional requirements like NDAA compliance and cybersecurity will add further complexity. All these additional technological challenges will slow down the overall progress drastically.

The balancing act between costs, supply chain sovereignty, market leadership, and industry adoption is challenging. On the other hand, “bringing home” production will strengthen the local economy and develop and retain talent in mobile robot technology, which is generally a good thing in times of increasing automation. All this requires a lot of investment, which is currently scarce in the commercial drone space.

Short, Resilient, Affordable, Yesterday

Achieving complete independence from Chinese drone components is a complex and long-term endeavor. Tariffs, bans, and sanctions will remain a defining feature of the drone supply chain, forcing companies to rethink sourcing and pricing strategies.

Supply chain security has become a top priority for governments and industries. Europe and North America are urged to create more resilient and secure drone supply chains by investing in domestic capabilities, fostering innovation, and implementing supportive policies.

As diversification accelerates, Western suppliers still face challenges scaling production and getting anywhere near Chinese cost structures. Innovation, strong collaboration, strategic partnerships, R&D, and alliances with allied countries will be critical in navigating this transition and ensuring the competitiveness of the Western drone industry in the global market.

Named one of the most influential people in the commercial drone industry, Kay established Drone Industry Insights as the leading drone market research consultancy in 2015. As well as personally consulting on projects and producing reports, he frequently speaks at conferences, seminars, and expos.

- 1 The Drone Supply Chain at a Crossroads

- 2 The Structure of the Drone Supply Chain

- 3 The Security Dilemma and Geopolitical Pressures

- 4 The US Tariff Shock

- 5 Supply Chain Vulnerabilities: Europe and North America

- 6 The Push for Localization and Diversification

- 7 How much is Supply Chain Sovereignty worth?

- 8 Short, Resilient, Affordable, Yesterday