UAV Stock Performance, Air Mobility Stocks, & Drone Technology ETFs

In 2021, we started monitoring and bringing you data on publicly traded drone companies and their UAV stock performance. This is because not a lot of individuals have the wherewithal to become a top drone investor, but they nevertheless want to get financially involved in the fast-growing global drone industry. And yet a quick google search for “UAV stocks” will often bring results that mention companies such as Kratos Defense, Boeing, FedEx, and Amazon among others. It’s like searching for water companies and being led to Pepsi. So in part 3 of our series on drone stocks, we review UAV stock performance, air mobility stocks, and drone technology ETFs. It is worth stressing that despite describing stock performance, this article is not meant to serve as investment advice.

Updated UAV Stock Performance

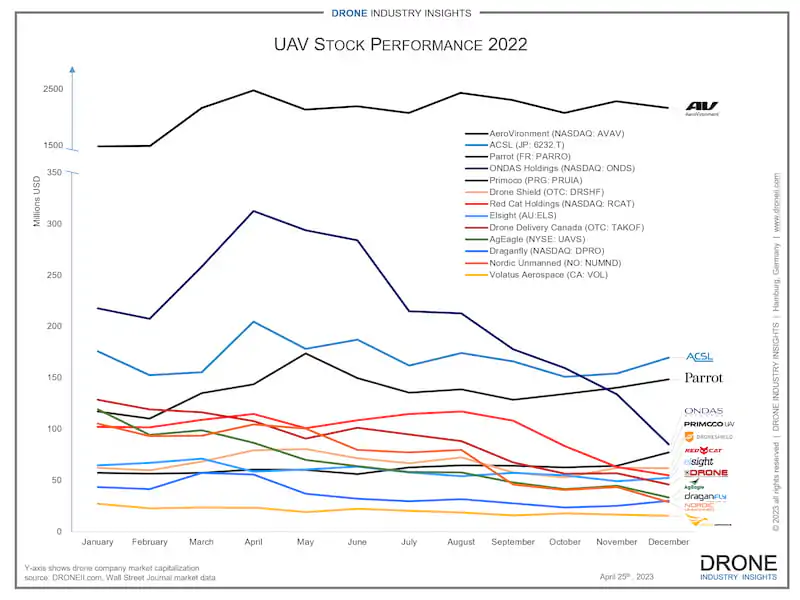

To evaluate UAV stock performance, we looked at the market cap of publicly traded drone companies (only hardware and service) from the beginning to the end of 2022. By focusing on the market cap and the calendar year, we are able to describe the performance of these stocks over a long period without updating a constantly changing price and currency exchange. It is worth stressing that the infographic shows the monthly average market cap (to avoid the daily day-to-day noise for all 13 companies).

Out of 13 companies on our shortlist, only 4 of them recorded an increase in market capitalization in 2022. Among these companies, Primoco UAV (PRG:PRUIA) has the highest percentage increase in its market cap (+62%), starting the year at a monthly average cap of US$57 million and finishing with US$93 million at the end of 2022. Primoco UAV is based in Czechia, was founded in 2015, and went public in November 2018. It is worth noting that despite its strong UAV stock performance, its low market cap likely stems from being traded in the Prague Stock Market and the value of its currency (1US$ ≈ 21CZK).

The other UAV stocks to register an increase in market cap for their company were: AeroVironment (NASDAQ: AVAV), Drone Shield (OTC: DRSHF) and Parrot (FR: PARRO). Two of these companies are featured among the top drone manufacturers, while the third is a market leader in counter-drone technology. Therefore, it is not surprising to see that their UAV stock performance was quite strong.

Among 9 companies that recorded a decrease, it is worth highlighting that the Japanese ACSL (JP:6232.T) showed a high level of stability, despite technically experiencing a slight decrease in monthly average market cap from US175 million to US$169 million. Meanwhile, AgEagle (NYSE:UAVS) experienced the biggest percentage loss in its market cap, starting the year with a US$119.2 million market cap and ending with US$33.4 million (loss of 72% market cap). Lastly, ONDAS Holdings (NASDAQ:ONDS) had the biggest absolute loss in market cap, going from US$217 million to start the year down to US$84 million (loss of 61%).

Advanced Air Mobility Stocks

Over the course of our blog posts on UAV stock, there has been a noticeable increase in advanced air mobility stocks. In 2021, there was only one company listed, which then became 5 in 2022, and has now reached seven advanced air mobility stocks. Since AAM is a topic covered extensively in our Advanced Air Mobility Report, the following section will only briefly discuss the stocks rather than the products or companies. From the outset, it is worth mentioning that all of the advanced air mobility stocks lost value over the course of 2022.

In order of market cap, the three companies which consistently held the highest market cap throughout all of last year were: Joby Aviation (NYSE:JOBY), Eve Air Mobility (NYSE:EVEX), and Vertical Aerospace (NYSE:EVTL). From all of these, the air mobility stock which showed the most stability was Eve Air Mobility, though it is worth mentioning that it only began properly trading in May of 2022. The company with the biggest loss in market cap from the start until the end of 2022 was Lilium (NASDAQ:LILM), which started the year at over US$1.6 billion and ended just over US$334 million. All other AAM stocks held a market cap below US$1 billion throughout the year, and they include Archer Aviation (NYSE:ACHR), Blade Air Mobility (NASDAQ:BLDE) and Ehang (NASDAQ:EH).

The main takeaway here is that, despite the stock performance, the EVTOL market still has some way to go before the products enter the market and yet there are already advanced air mobility stocks being traded. This is an opportunity for those who want to monitor and invest early in this drone industry segment that will continue to evolve in the coming decades.

AdvisorShares Drone Technology ETF

We conclude with a new and interesting addition to the data on UAV stock performance: the only ETF available that is focused on drone technology. According to the Wall Street Journal, the investment policy followed by AdvisorShares Drone Technology ETF is the following: “The Fund seeks long-term capital appreciation. Under normal circumstances, the Fund invests at least 80% of its net assets in securities of companies that derive at least 50% of their revenue or profit from the use and/or manufacture of drones or technology used in the development and manufacture of drones.” Does this mean it’s the right ETF for anyone looking to invest in drone technology?

Based on the data, there is one imperative observation that needs to be made: the ETF’s portfolio cannot truly be said to be a “drone technology ETF”. As of 28 February 2023, its top 3 holdings are: Jabil (10.27%), Axon Enterprise Inc. (6.12%), and AAR Corp. (4.89%). Other companies in its top 10 include Airbus, FedEx, and UPS. Do these companies ring a bell within the drone industry? Perhaps, but not as “drone companies”. By our definition, the top drone companies in AdvisorShares Drone Technology ETF are: Ehang (4.36%), AeroVironment (3.48%). Therefore, by our definition of “UAV stocks” (which is the purpose of this series), this does not qualify as a drone technology ETF despite its name.

Interested in going beyond UAV stock performance? Check Out Our Latest Drone Investment Database!

Drone Investments Database 2023

• 27-page Summary + 2 Databases (Investments and Partnerships)

• List of 1,600+ investments around the world since 2010 by region & country

• UAV stock performance for drone stocks throughout all of 2022

• Listing of 1,200+ partnerships since 2015, including both partners’ regions

Conclusion: The Top UAV Stocks

Before we finish this blog, it is worth reiterating that this article aims to highlight UAV stocks focused on drone technology, not to give investment advice. The UAV stock performance that is described represents how these publicly listed companies have performed over the period analyzed, not how they will perform. Predicting UAV stock performance is a much more volatile and much less scientific endeavor than drone market forecasts. And there is no such thing as a DJI drone stock, Skydio stock, or specific Amazon drone delivery stock, which would provide a closer connection between the financial market and drone company activity.

With all of this being said, the top UAV stocks in terms of performance are Aerovironment, ACSL, and Parrot which are among the most well-established UAV companies and whose UAV stock performance remained steady throughout 2022. AeroVironment has the highest stock price, ACSL showed the most stability, and Parrot displayed plenty of adaptability and business strategy (e.g. by selling SenseFly to AgEagle), which is shown by the increase in stock price through 2022. Nevertheless, there are other companies that are relatively fresh into the financial markets such as Droneacharya (BOM:543713) in India, and the upcoming ParaZero (NASDAQ:PRZO) among others.

Finally, it is worth keeping an eye out on advanced air mobility stocks and their development over the coming years while they seek to bring their products to market. Most of these companies entered financial markets through SPAC mergers that were meant to raise capital for their product development and the certification process. However, it is understandably difficult to be a publicly traded drone company and keep a high stock price without any actual product or service on the market [yet]. Hence why they will not be on top of any top stocks list any time soon but are still worth keeping an eye out in the long term. Thankfully that provides potential investors with enough time to get informed on which are the top UAV stocks for their individual portfolios.

Download our FREE UAV Stock Performance Infographic

The “UAV Stock Performance Infographic”, shows how publicly traded drone service and drone hardware companies performed in the stock market during 2022. The UAV stock performance is measured by looking at the average market capitalization during each month of 2022.

Besides his financial oversight, Hendrik is an expert in aviation law and UAV regulation with more than 10 years of experience. Not only does he consult on all regulation questions, but Hendrik also writes the yearly drone investments report. Prior to launching DRONEII, at Lufthansa Technik he was the single point of contact to Civil Aviation Authorities (CAA) of Germany, Middle East and Asia.