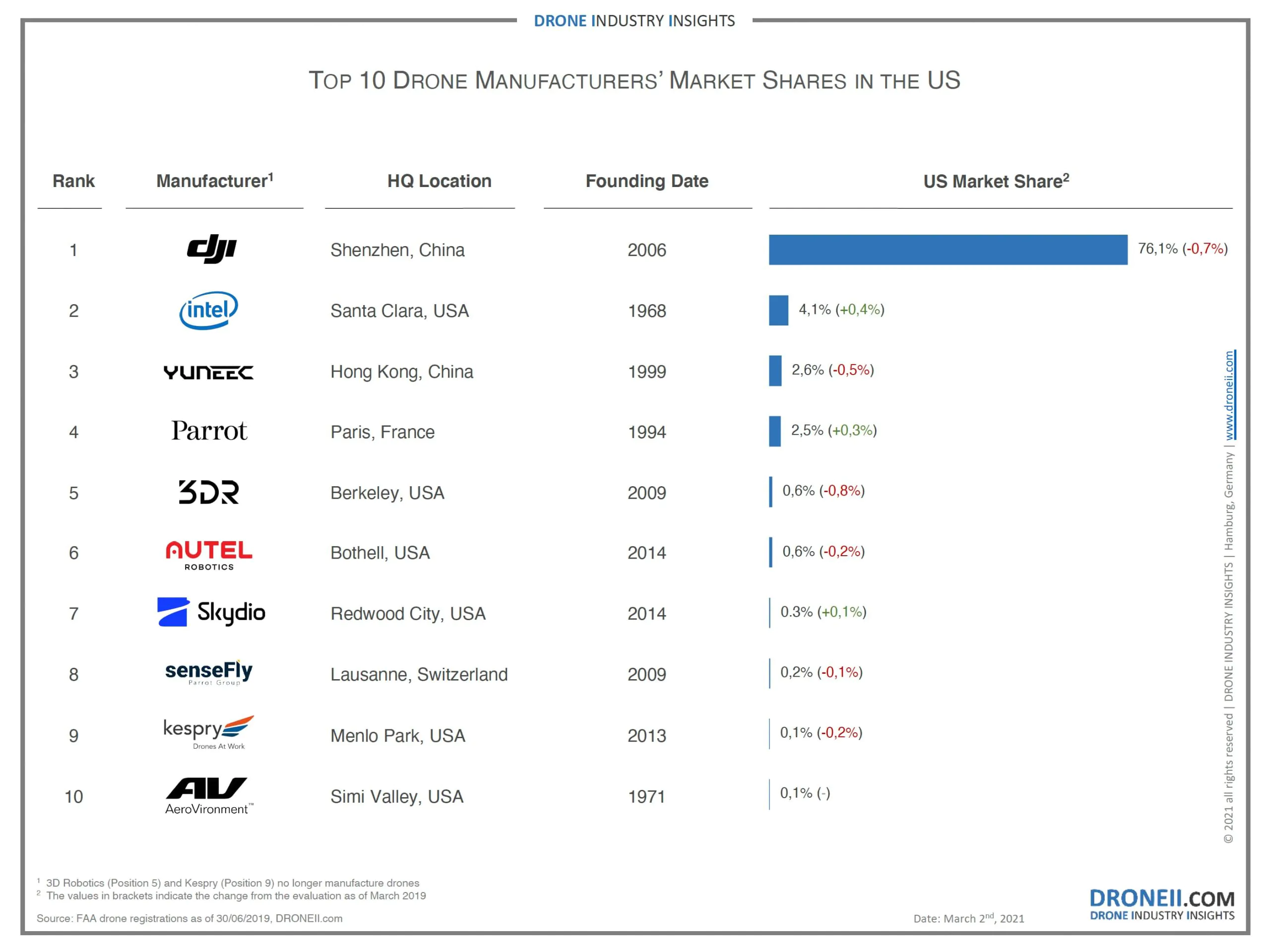

First of all, it is worth mentioning that there are no major changes. DJI, Intel, Yuneec and Parrot still lead the ranking, but there are some new drone OEMs showing up compared to our last raking. Consequently, this also means that the drone ban has not resulted in a significant decline for DJI in terms of market share so far. Whether the manufacturer might have had more shares otherwise is impossible to judge. A dent in DJI’s reputation has definitely occurred in some parts of the industry thanks to the accusation, whose legal merit has not yet been established. But there are some other things that are worth mentioning:

The non-plus-ultra in terms of drone market share is and remains DJI. 76.1% of all entries in the database are from the Chinese company. This is despite the 0.7% decline since the mid-2019 ranking, which is of little consequence given this magnitude of market power. The most registered drone model was the Mavic Pro, which has been available on the market since late 2016. The Mavic Air 2, which did not hit the market until spring 2020, and was thus only 2 months into the data collection period, stood out as the new box office hit.

The company Intel, known mainly for the production of semiconductors, ranks 2nd, which is certainly a surprise to many. However, about 98% of Intel drones are Shooting Star drones, which are used for drone shows in several hundredfold numbers. The number of Falcon 8 and Falcon 8+ inspection drones taken out of production has roughly halved compared to 2 years ago.

Yuneec was able to defend its 3rd place on the podium ahead of Parrot Drones. The former lost less market share than DJI (-0.7% vs. -0.5%), though this is much more significant given that their total drone market share is now only 2.6%. Particularly since mid-2019, the Chinese company has continued to come under pressure, the number of new registrations to direct competitors was comparatively lower.

The subsidiary of Parrot SA (PARRO: EN Paris), Parrot Drones, gained 0.3% drone market share and is currently only 0.1% behind Yuneec with 2.5%. The French drone manufacturer has now completely left the hobby drone market and is only focusing on the commercial market. Additionally, the inclusion of the Parrot Anafi-USA drone on DIU`s (Defense of Innovation Unit) list of “Trusted sUAS Options for DoD and Federal Government” will certainly have a positive effect for Parrot Drones in the future (this was after the period under current review).

Autel Robotics was also unable to completely maintain its drone market share and suffered minimal losses but is still defending 5th place. The drone models EVO II, EVO II Pro and EVO II Dual, which are of interest to the commercial drone industry, were released only a few months before the end of the data collection. That means it will be interesting to see how the trio of models affected Autel’s drone market share in the next ranking.

The next company in the top 10 ranking is Skydio which was only founded in 2014. The company recently raised $170 million on a unicorn valuation topping $1 billion to enable it to expand globally and accelerate product development and was able to increase its drone market share by around one third for its highly automated drones. This is primarily due to the Skydio 2 drone launched in November 2019, which is mainly designed for the prosumer sector for film & photography. The Skydio X2, with its two versions X2E (for commercial purposes) and X2D (for military purposes), and the Skydio Dock are also eagerly awaited, with a lot of promising features to enter the commercial (and military) drone space.

As the drone market share of Skydio increased, senseFly – the swiss fixed-wing manufacturer and subsidiary of Parrot Group – lost one third of its market share. The most popular senseFly drones in the U.S., the ebee X and ebee Plus, both lost on traction in the U.S.

U.S. drone manufacturer AeroVironment (NASDAQ: AVAV), which produces unmanned aerial systems for both commercial and military markets, is also on the DIU list of trusted manufacturers in the United States. The company’s market share for commercial drones has remained about the same in recent years.

The companies ranked in Position 5 and 9, 3D Robotics and Kespry respectively, have both exited the hardware business, but still hold sizable shares of registered drones in the US. The former has focused on drone mapping software for construction and engineering professionals, while the latter has developed an end-to-end data collection and analysis solution using mainly third-party hardware