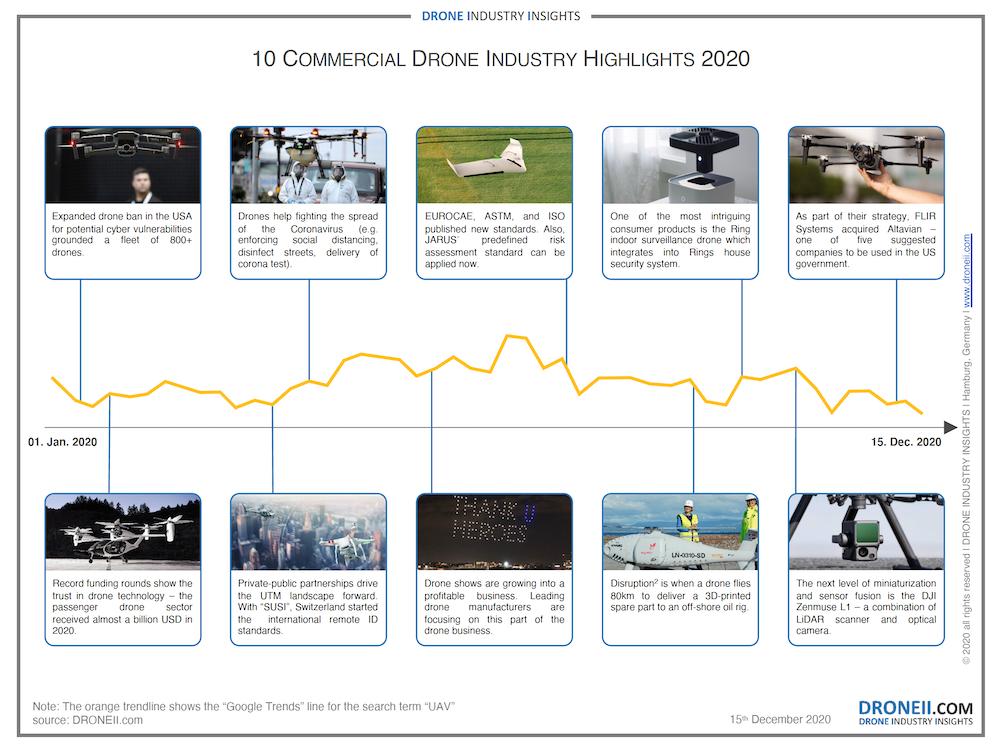

As 2020 comes to an end we recap a rather extraordinary year and feature relevant developments and selected highlights in the commercial drone industry 2020. In line with our global drone outlook for 2020, we saw that, despite a global pandemic, significant regulatory progress was made, products were improved, services were refined, and public acceptance grew.

It’s been a busy year with business growth, record funding, and company acquisitions. However, companies also struggled due to reduced demand. Same as always you might think, but in 2020 it was amplified to the extremes.