26 min read · Created: 2020-01-07 · By Millie Radovic

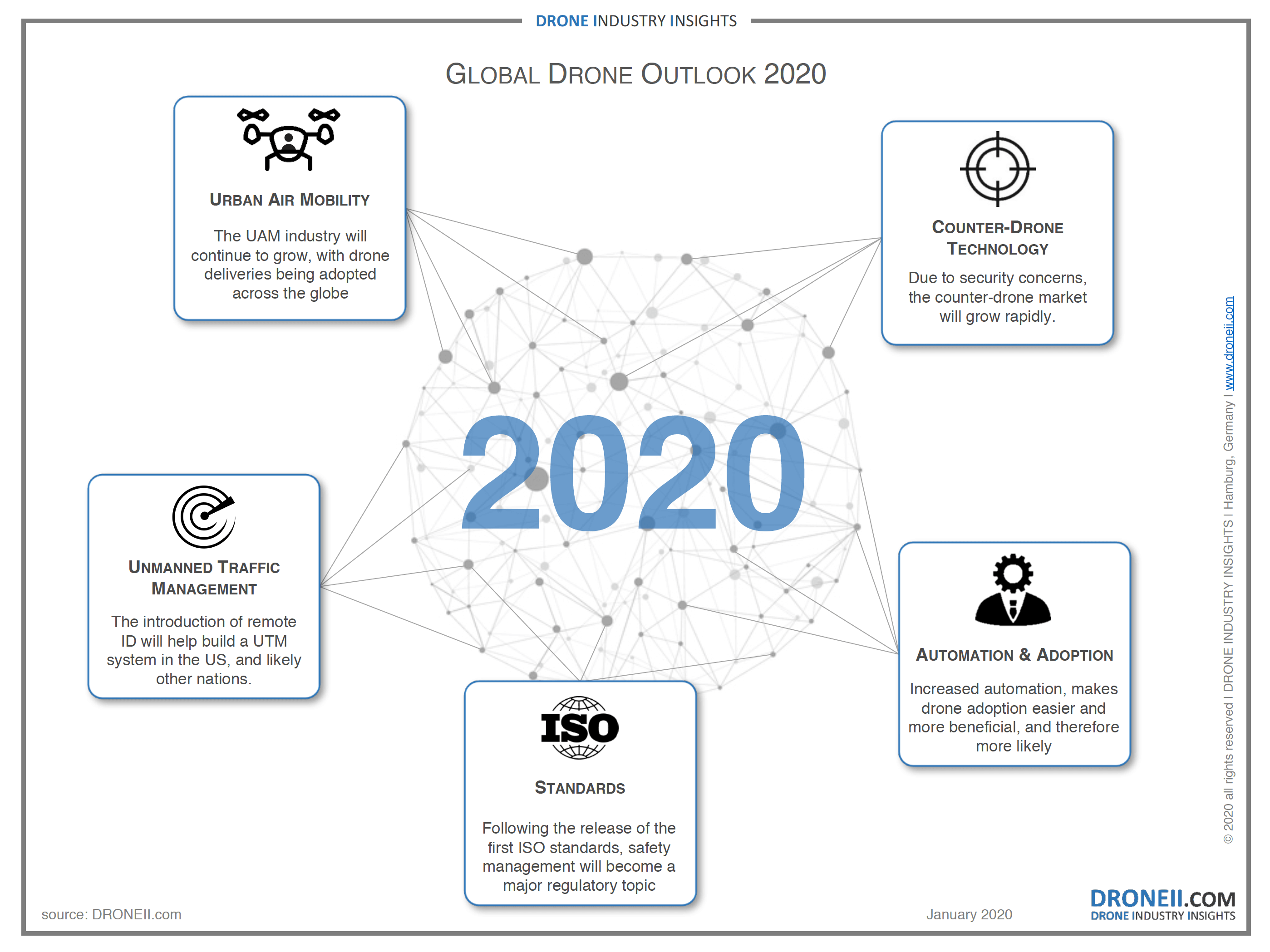

Global Drone Outlook 2020: What's on the Agenda

Counter-Drone Technology

Following a series of highly publicised incidents in 2018 and 2019, the counter-drone market took off and grew rapidly last year. The sheer number of counter-drone solutions available almost doubled, nations began to formulate counter-drone strategies and the array of solutions available continued to grow. This market is expected to continue to grow and mature in 2020 – we’ll see more solutions, more money, more contracts, and more advanced technology flooding the counter-drone industry.

The question that remains is, will more advanced counter-drone technology, especially interdiction tools, remain limited to the realm of government actors, the military and critical infrastructure like airports, or will it become a standard across verticals and public and private spaces?

Urban Air Mobility (UAM)

Urban Air Mobility has been a huge topic since the very beginning of the commercial drone industry, with companies beginning to develop passenger drone concepts early on. Last year, UAM was a particularly prominent topic as drone deliveries began to take off in Australia, the United States, Ghana and elsewhere. From medicine to food, retail packages and industrial materials, companies are developing aerial delivery solutions for both urban and rural spaces.

In 2020, expect further developments in the drone delivery industry, while passenger drones are likely to trail somewhat behind due to the much higher regulatory and technological toll that they face. More specifically, companies developing passenger drones,(also known as flying cars, air taxis and eVTOLs) will need more time and a significant amount of funding to get certified (this process has been estimated to cost around $1 billion per platform).

While the regulation is not a showstopper in the drone delivery industry, access to a combination of reliable technology combined, a nearby expert network and funding (because many small tech companies in the drone delivery sector are totally underfinanced) is currently the biggest challenge.

There are also big regional difference in terms of drone delivery activity and overall UAM progress. While Chinese drone delivery service providers already operate frequently even in urban areas, the US is still in the test stage and struggle with high requirements to operate in public environment. The key to getting ahead now won’t just be in governments issuing special permits, but in the set-up of an approval system (such as the Part 135 in the US) which will allow for the scaling of drone deliveries.

Download our FREE Global Drone Outlook 2020 Infographic

This infographic breaks down the global drones outlook for 2020 giving you the latest trends.

Unmanned Traffic Management (UTM)

The drone industry, more specifically those working in unmanned traffic management (UTM), will prepare for Remote ID standards. Remote ID will introduce the ability of a drone to provide identification information that can be received by other parties. To enable this, the US Federal Aviation Authority (FAA) published proposed a 319-page Remote ID rulebook for public comments in December 2019. One highlight is the selection of nine core suppliers like Airmap, Kittyhawk or Unifly, which will be approved by the end of the year to be contracted by the FAA to supply remote ID services for the US airspace.

In Europe it’s expected that the EASA will publish an Opinion about Remote ID and their U-Space initiative in the first quarter of 2020. It will be interesting to note how these proposed rules differ from the US rules. Remote ID shall avoid the use of ADS-B (Automatic Dependent Surveillance-Broadcast) technology on drones. The FAA is afraid that the high expected drone traffic will negatively affect available ADS-B frequencies, which then will in turn also affect ADS-B capabilities for manned aircraft creating a possible safety risk. All of these developments raise many questions for the year ahead.

Will these remote ID standards also affect the market share of DJI (already affected by the US-China trade war) who have planned to start in 2020 to installing ADS-B receivers in all new drones above 250 grams? Can all countries follow the EASA timeline that EASA members have to set up a registration procedure?

Adoption and Automation

Meanwhile, across the board adoption of drone technology will continue. As mission complexity sinks (due to higher automation and workflow integration) more companies will start drone operation or pull outsourced operation in. This is reflected in the growing commercial drone market forecast for the next five years.

Part of the reason for increased and continued adoption is certainly automation, both in terms of data processing and mission execution. “Actionable Data” is next to a powerful and reliable drone probably the most important driver of the drone industry, as one of our earlier articles showed. Drones often generate large amounts of data – sometimes more than we can handle. The faster, the more accurate, and the easier the images can be evaluated, the better. Further development in AI algorithms can help to reach these goals e.g. by looking at thousands of pictures of wind turbine blades without a human in the loop.

There are continuing efforts in automated mission execution as it can be seen e.g. with the Skydio 2. The drone uses AI approaches to automatically find ways where to fly and comes optional with a box where the drone can launch and land. The Skydio 2 Dock is a self-contained, weatherproof, charging base station for the drone and is designed to further automate processes at e.g. worksites by a persistent presence of the drone.

ISO Standards

2019 closed off with the announcement of the first ISO approved drone safety standards in December. This means that in 2020 the set-up of a safety management system will be a major regulatory topic. It also means that the foundation for future rulemaking, standardising and legislating of drone operations has now been laid.

The key challenge in 2020 will lay in the implementation and harmonization with national standard coordinating bodies (ANSI, JSI, DIN, etc.) and the compatibility of these standards with existing drone regulations.

Want to know more about these or other 2020 trends in the commercial drone industry? Get in touch!

DRONEII’s token social scientist, Millie has a BA in International Relations from King’s College London and an MSc from the University of Oxford. Earlier, she amongst other things researched Science & Tech policy for the NATO Parliamentary Assembly in Brussels. At DRONEII she particularly looks at drones and international development & global health projects.