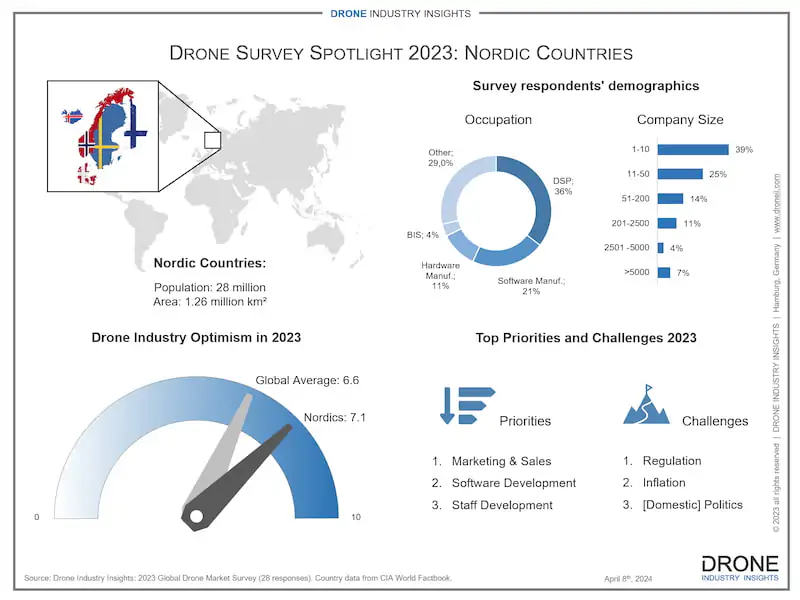

Survey Snapshot: the Nordic Drone Market

Note: The following information about Nordic drone companies is based exclusively on data from our latest drone industry survey and is not a comprehensive drone market study. Therefore, it should be interpreted as a glimpse into the Nordic drone market rather than in-depth authoritative research. For a more thorough study, please contact info@droneii.com

While it is not often mentioned under the usual listings of “global regions”, the Nordic region has a very rich history and a dynamic culture that spectacularly balances integration and segregation. This region includes the Scandinavian countries of Denmark (including Greenland and the Faroe Islands), Norway and Sweden, as well as neighboring Finland and Iceland. Though entire books and encyclopedias could be written about these countries’ similar-yet-different histories and languages, their drone markets are equally vibrant.

Opportunity for Drones in the Nordics

The Nordic countries have a combined population of 28 million people, with Iceland having the smallest population (361 thousand) and Sweden having the largest (10.5 million). Geographically, these countries cover a substantial area of 1.26 million km². Norway, Finland and Sweden cover areas between 323,000-450,000 km² and Denmark is by far the smallest country at 43,094 km² (including Greenland and the Faroe Islands) which is half the size of Iceland (103 km²). All of this means that the Nordic countries as a whole have a cumulative population density of 22.29 people per square km, though the average density is 39.7 people per km² given the vast difference between Denmark (138) and Iceland (3.5). How does all of that translate into the use of drones in the Nordic countries?

In recent news, the AQUADA-GO project, funded largely by the Danish Energy Technology Development and Demonstration Programme (EUDP) is developing drone technology with AI to automate the inspection of offshore wind turbine blades while they are still spinning, which could reduce the cost and carbon footprint of inspections compared to the current manual process. Meanwhile, the Icelandic authorities plan to use its high-end drones equipped with ground-penetrating radar to map the extent and aftermath of the Eldvörp-Svartsengi volcanic system eruption in Iceland, which has rendered the nearby fishing village of Grindavík uninhabitable.

In Finland, a study found that LTE mobile networks can be effectively used for low-capacity command and control links in beyond visual line of sight (BVLOS) drone operations in rural areas of Finland, especially when using terminals with multiple simultaneous LTE connections to ensure reliable coverage. Naturally, Russian military activity has also led to more focus on surveillance applications. The Norwegian government plans to invest in long-range drones for sea surveillance in the High North, while the Swedish Home Guard has selected the Parrot Anafi USA drone to enhance its surveillance and protection capabilities.

* All country data from the CIA World Factbook

Nordic Drone Market Composition

At this point in the country market series, at least one important pattern has become evident: wealthier countries tend to have a higher share of small drone companies. The Nordic drone market is no different, where practically 4 out of 10 companies are composed of 10 employees or less. Another 25% of drone companies in the Nordic countries have between 11-50 employees meaning that 65% of the Nordic drone market is made up of companies with 50 or fewer employees. Conversely, however, 11% of survey respondents reported a company size of more than 2,500 employees. Therefore, the market is not exclusively limited to small companies and there are also large drone companies as well as big corporations with large drone programs.

When it comes to their business activities, it is once again Drone Service Providers (DSPs) that represent the largest share of the Nordic drone market (36%). Again, given the plethora of use cases for drone technology, it is very often the case that companies specialize offering in a particular drone activity as a business service and consequently DSP represents the largest share of the market. Interestingly, Software Manufacturers (21%) represent the second-biggest share of the Nordic drone market. Many people might not consider Denmark, Finland, Iceland, Norway or Sweden as software powerhouses, but there are nevertheless plenty of promising drone software companies in the region.

Interested in the Commercial Drone Market? Check Out Our Latest Drone Market Report!

Drone Market Report 2023

• 227-page drone market report featuring:

• Commercial drone market + recreational drone market

• Breakdown of data by: segment, industry, method, region, and country

• Additional chapters on regulation and rising technology trends

Priorities and Challenges for Nordic Drone Companies

Much like the rest of the world, the top business priority in the Nordic drone market is Marketing & Sales. As mentioned before, now that both drone hardware and software are highly developed and reliable, companies in general focus less on the development stage and more on marketing and selling their products. Naturally, however, there is still some need for customization and/or sophistication for specific tasks, which is perhaps why software development is the second priority for drone companies in the Nordic countries. This is also likely connected to the increased emphasis on surveillance that was mentioned at the outset.

In terms of challenges, the usual suspect of regulation once again tops the list. This has been the case since previous years because of the slow pace of regulatory implementation. However, as more laws take effect throughout the world, the amount of drone activity is set to increase while the concern over regulation should be expected to decrease. [High] Inflation, the second-place challenge for the Nordic drone market, has also been a primary concern in other countries surveyed, but it is nevertheless a temporary phenomenon. Lastly, Domestic Politics was listed as a third challenge, which is in a sense surprising given the relatively stable political environment of the region as a whole.

Nordic Drones: Open to the World

Overall, drone companies in the Nordic countries are more optimistic than the global average. With a score of 7.1 compared to 6.6, the higher optimism is quite robust even if not as eager as places like India. However, India’s optimism is propelled by strong protectionist national policies while the Nordic drone market is simply carrying on with business as usual and instead focuses on opening up to the world. This is evidenced by companies such as Everdrone (Sweden) which has shown the world the life-saving potential of drone technology or Nordic Unmanned (Norway) which operates far beyond the Nordic borders. Perhaps the best example of this openness is the International Drone Show, which brings together Scandinavia’s leading companies as well as other drone industry leaders from around the world.

Stay tuned as we continue to feature more countries and regions with unique and exclusive data from our annual Drone Industry Survey. If you are interested in learning more about the global drone market, you can find detailed data by sector, industry, method, region, and country in our flagship Drone Market Report.

And if you are interested in all the ins and outs of a particular region or country, including information on individual companies, you can contact us to discuss a comprehensive drone market study. Please contact info@droneii.com with the subject “Customized Drone Market Research”.

Download our FREE Drone Companies in the Nordics Infographic

Our Infographic about drone companies in the Nordics shows a market breakdown of what drone companies do, their size, top priorities and challenges. It also features an optimism meter comparing drones in the Nordics with the rest of the world.

Besides his financial oversight, Hendrik is an expert in aviation law and UAV regulation with more than 10 years of experience. Not only does he consult on all regulation questions, but Hendrik also writes the yearly drone investments report. Prior to launching DRONEII, at Lufthansa Technik he was the single point of contact to Civil Aviation Authorities (CAA) of Germany, Middle East and Asia.