Survey Snapshot: the North American Drone Market

Note: The following information about drone companies in North America is based exclusively on data from our latest drone industry survey and is not a comprehensive drone market study. Therefore, it should be interpreted as a glimpse into the North American drone market rather than in-depth authoritative research. For a more thorough study, please contact info@droneii.com

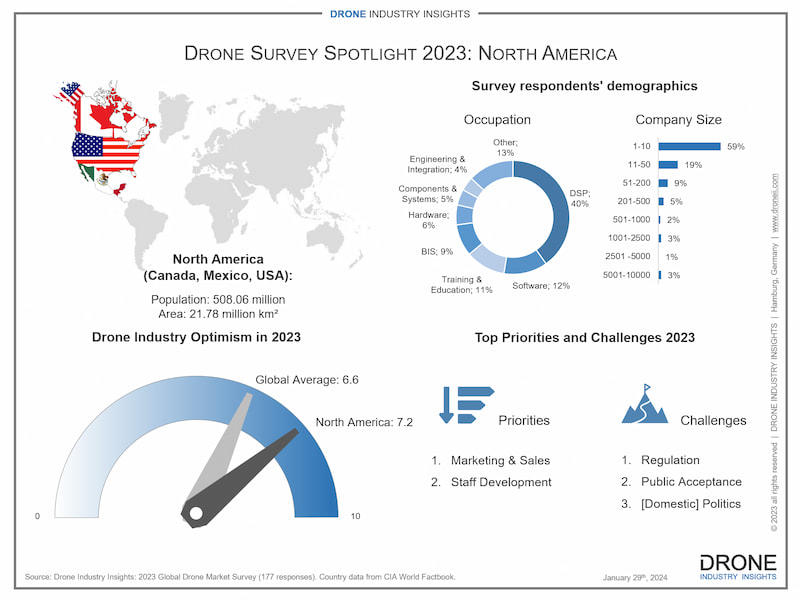

In the first article of our country series for 2024, we turn our attention to the New World. The North American drone market is the #2 global region for drone technology (behind Asia) although it is only made up of three countries: Canada, Mexico, and the United States of America.

Recent headlines about drones in North America feature drones used for archaeology in Alberta, Canada, drones providing news footage of Acapulco, Mexico in the aftermath of Hurricane Otis, and drones carrying out search-and-rescue after a landslide in Alaska or putting on drone shows in Texas (among others) to celebrate the New Year. So let us dig deeper into one of the most fascinating and dynamic regional drone markets.

Opportunity for Drones in North America

Not only is the North American drone market already one of the leading regions for drone technology, but it also has incredible potential to develop even more. All three countries rank in the top 15 globally in terms of country size and real GDP. Furthermore, two are in the top 10 in terms of population size (USA and Mexico), and two are in the top 5 in terms of country size (Canada and the USA). This means that whether it is providing services to people or carrying out operations in remote or hard-to-reach areas, there is a lot that drones will be able to do more efficiently than any other alternative.

The potential for the use of drones in North America is not only vast given the size of the region and the power of its economies. This potential is also distinctly aligned with the unique landscapes and specific needs of the United States, Mexico, and Canada. Each country’s distinct geographical and societal features provide unique chances for drone technology to address specific national challenges and opportunities, especially given the developed infrastructures, industry assets and staff shortages in various industries where drones could make an impact.

For example, in the United States, drones are set to revolutionize urban management and emergency response, especially in densely populated areas where 83.3% of the population resides, addressing disaster management and logistics challenges. Mexico, with its extensive agricultural land covering 54.9% of its territory, presents a prime opportunity for drones to enhance agricultural efficiency and precision farming, significantly impacting its predominant farming sector. Canada, characterized by its vast forests covering 34.1% of the land and the world’s longest coastline, offers unique applications for drones in environmental monitoring, forest management, and maritime surveillance, particularly in its remote and arctic regions.

With all of this considered, it is no surprise that the North American drone market is forecast to surpass US$12.2 billion by 2030. To gain a more proper understanding of its composition, let us now have a glimpse into the work that drone companies in North America carry out.

* All country data from the CIA World Factbook

North American Drone Market Composition

Much like in other developed economies, there is a very high number of small drone companies in North America, with 59% having 10 employees or less and a further 19% employing up to 50 people. This means that almost 80% of the North American drone market is composed of small and medium-sized enterprises (SMEs).

Although drone companies in North America are mostly drone service providers (DSPs), the share of DSPs in this infographic (40%) might seem low in comparison to the global drone industry (made up of 80% of DSPs). But the current figure breaks down DSPs into further categories auch as the 11% that provide Training & Education services and the 4% that do Engineering & Integration among others. Either way, North America has a wide range of companies beyond the drone service providers, which include the 12% that focus on Drone Software and the 9% that use drones internally (BIS).One important note regarding BIS is that there are in fact substantially more of these types of companies in the North American drone market, but this data is based on the results of the 2023 survey, which had limited outreach towards these types of companies.

It is also worth noting that almost 10% focus on either Components & Systems Manufacturing or Engineering and Integrating them into existing drone hardware. So, a total of 15% of the drone industry in North America is focused on some sort of hardware, whether it be building a drone itself, its components, or integrating the two.

In a nutshell: the North American drone market features a very healthy and diverse mixture of services, hardware, and software, not to mention a high level of education (including university programs/degrees focused on drone technology) as well as companies that use drones themselves rather than offering them as services. The “Other” category in the infographic includes resellers/distributors, media platforms, researchers, and companies that carry on various activities.

Only about half of the drone companies are members of an association. Specifically, respondents expressed some skepticism about the value of drone association memberships, citing a lack of meaningful representation or direct benefits relative to the costs involved. Many highlighted organizational priorities and financial constraints as key factors in their decision-making, with startups and educational institutions focusing on immediate business needs or sector-specific associations instead. Additionally, a significant number of responses indicated a lack of awareness about drone associations or their relevance to the respondents’ specific geographic areas or industry sectors.

Interested in the Commercial Drone Market? Check Out Our Latest Drone Market Report!

Drone Market Report 2023

• 227-page drone market report featuring:

• Commercial drone market + recreational drone market

• Breakdown of data by: segment, industry, method, region, and country

• Additional chapters on regulation and rising technology trends

Priorities and Challenges for Drone Companies in North America

The main priority is firmly determined to be Marketing & Sales, followed by Staff Development. As in many other parts of the world, this prioritization makes sense given that product development (both hardware and software) has reached a very advanced stage. Many companies are now easily able to develop adequate products that can be put into the market, and it is now a matter of finding the right strategies to market and sell those very products.

Moreover, the second priority shows that it is now imperative to have employees equipped with adequate knowledge within this niche industry. Whether it be building durable drone hardware, developing sophisticated drone software, highlighting the right USP (unique selling point), or anything else that a drone company might need, the issue of hiring and developing the right staff has risen in importance and will continue to do so in the coming years. (Note: Software Development and Finances & Funding both ranked third, which is why there is no official third place priority listed in the infographic for the region).

Based on input directly from drone companies, the top challenges for drones in North America are 1) Regulation, 2) Public Acceptance, and 3) Domestic Politics (slightly beating out fourth-place inflation). When asked directly for comments, respondents highlighted several critical challenges that drone companies in North America are currently facing. Key among these is navigating a complex regulatory landscape, with evolving FAA regulations and international constraints being a significant concern.

Drone companies in North America also emphasized the struggle with market perception and the need for enhanced client education, particularly in understanding the sophisticated data drones provide. The prevalence of unqualified drone service providers is reportedly affecting the market’s reputation and safety standards. Operational challenges such as supply chain disruptions and fierce competition with larger, more established players were also noted as significant hurdles within the North American drone market.

North American Drones: A Vision for Tomorrow's Skies

The North American drone market is experiencing a significant upswing in optimism, evident from the increase in confidence levels from 6.3 in 2022 to 7.2 in 2023. This optimism not only outstrips the global average of 6.6 but also highlights the region’s progress and potential in the drone industry. Alongside this growing confidence, there have been notable advancements in regulatory frameworks. These regulatory developments are crucial in fostering a conducive environment for drone technology growth and innovation. This dual progress in both market sentiment and regulation underscores the region’s commitment to harnessing the transformative power of drone technology.

As we look towards the future, the North American drone market stands as a beacon of innovation and progress. The blend of soaring optimism and regulatory efforts positions the region not just as a market leader but also as a visionary in the global drone landscape. The journey ahead is filled with possibilities, from revolutionizing urban management to enhancing agricultural efficiency and environmental monitoring. As the skies above North America buzz with the potential of drone technology, it’s clear that this region is not just navigating confidently through the present but is also shaping the future of drone applications.

The story of commercial drones in North America is one of ambition, adaptability, and a forward-looking perspective, promising a sky filled with innovation and inspiration.

Stay tuned as we continue to feature more countries and regions with unique and exclusive data from our annual Drone Industry Survey. If you are interested in learning more about the global drone market, you can find detailed data by sector, industry, method, region, and country in our flagship Drone Market Report.

And if you are interested in all the ins and outs of a particular region or country, including information on individual companies, you can contact us to discuss a comprehensive drone market study. Please contact info@droneii.com with the subject “Customized Drone Market Research”.

Download our FREE Drone Companies in North America Infographic

Our Infographic about drone companies in North America shows a market breakdown of what drone companies do, their size, top priorities and challenges. It also features an optimism meter comparing drones in North America with the rest of the world.

Besides his financial oversight, Hendrik is an expert in aviation law and UAV regulation with more than 10 years of experience. Not only does he consult on all regulation questions, but Hendrik also writes the yearly drone investments report. Prior to launching DRONEII, at Lufthansa Technik he was the single point of contact to Civil Aviation Authorities (CAA) of Germany, Middle East and Asia.