The Flourishing of Commercial Drones in Germany and Switzerland

“Made in Germany” and “Swiss-made” are phrases that will likely gain renewed prestige thanks to commercial drones in Germany and Switzerland. Internationally, both of these countries are historically known for things like cars and watches, and more generically for engineering, punctuality, and precision. Perhaps this is also why both countries have had a strong influence on drone technology. In light of recent studies for the German Verband Unbemannte Luftfahrt (VUL) and the Drone Industry Association Switzerland (DIAS), we want to provide some insight into how drones are boosting their respective economies.

Drone Technology in Germany and Switzerland

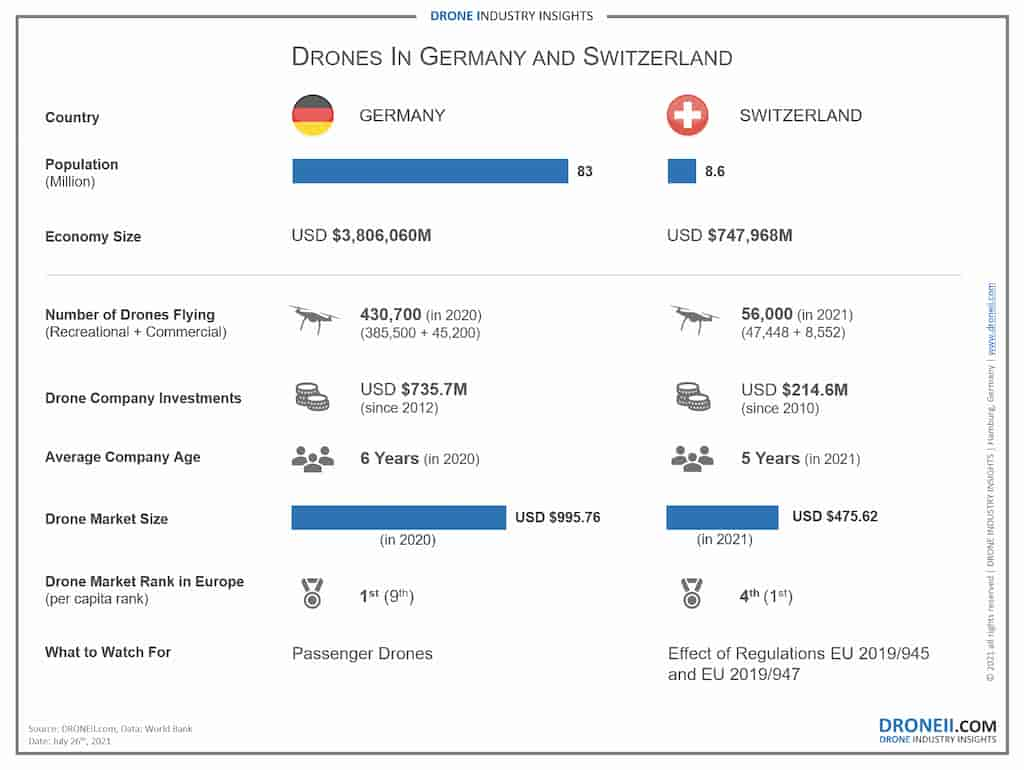

The amount of investment going into commercial drones in Germany since 2012 is €620M (US$735.74) making it one of the top countries in the world for drone investments. Swiss drones have also received plenty of investment, accumulating a total of US$214.6M in investments since 2010. These solid investments are one reason why both Germany and Switzerland have very strong commercial drone markets. In 2021, the German drone market is worth €840M (US$995.76M) while the Swiss drone market is worth CHF 435.4M (US$475.62M).

In terms of ranking within Europe, this places the German market as the number one market in absolute terms and number 9 per capita. Meanwhile the Swiss market ranks fourth in absolute terms and is the number one market on a per capita basis. Therefore, it is not surprising that both markets at expected to grow at rates of 14.5% CAGR in Germany and 10.6% in Switzerland.

To understand both markets more thoroughly, let’s dive slightly deeper into our public studies commissioned by the German unmanned air vehicle association and the Swiss drone association, though it’s worth noting that the underlying data for these studies were from different years.

Commercial Drones in Germany

In Germany there are approximately 430,700 drones flying. This figure consists of around 385,500 private drones and 45,200 commercial drones. Although there are fewer drones flying commercially, commercial drones in Germany account for €738M, which is 87.86% of the total drone-related revenue in the country. Furthermore, unlike the -1.4% CAGR decline projected in the recreational drone market, the commercial market is expected to grow at a rate of 14.5% CAGR for the next 5 years.

What do companies specialize on in Germany? According to our study with the German VUL, 79% provide drone-related services, while 15% work on hardware and 6% do software. The average company age is 5.6 years with an average of 17 employees and an average yearly revenue of €670,000. These companies are spread throughout Germany, but there are slightly larger concentrations in the states of Bavaria, Nordrhein-Westfalen, Berlin, and Baden-Württemberg.

Eyes on the future: the main thing to keep an eye on for the commercial drones in Germany is passenger drones. Most passenger drone companies currently plan on starting regular operations in 2024, and although their businesses may not become profitable until 2030 or beyond, this new mode of transportation promises to be a major game-changer. There have been billions worth of investment into these companies over the past years, and Germany is home to two major headliners. Therefore, advanced air mobility is certainly one thing to keep an eye on in Germany.

Commercial Drones in Switzerland

Though Switzerland is a country 10x smaller than its neighbor, Germany, in terms of population, the number of commercial drones in Switzerland is not 10x smaller. There are approximately 56,000 drones (47,448 private; 8,552 commercial), meaning there are more drones per person. Moreover, the commercial drone market (CHF 416.4M) represents 96.64% of total drone-related revenue, which helps explain why Switzerland is the top country in terms of commercial drone revenue per capita. Its projected growth rate is 11% CAGR while the Swiss recreational drone market is also expected to have a decline of -0.9%. As the drone industry matures and more companies adopt drones for their business processes, we are likely to see more of this slight decline in recreational drones and sharp increate in commercial drones.

What do companies specialize on in Switzerland? Much like commercial drones in Germany, the greatest share of companies provide drone services (86.8%), followed by hardware (10.4%) and Software (2.8%). Perhaps one distinguishing factor of commercial drones in Switzerland is the very startup-friendly environment. According to our study with the Swiss drone association, 60% of drone companies were founded in the last 5 years. Switzerland has a strong culture of research and innovation, especially at universities like ETH Zurich and EPFL. This explains the drone hubs surrounding cities like Zurich and Lausanne.

Eyes on the future: perhaps the most pressing issue for commercial drones in Switzerland is the regulatory path. Up until now, Switzerland has been good at allowing several types of companies to test their drones and services before bringing them to market. However, there is currently a debate about the path that the country will take in regard to ratifying regulations EU 945/EU 947. Their adoption could affect this and other aspects of companies’ operations.

National Drone Associations

In addition to VUL and DIAS, there are other country-specific drone associations such as the recently-formed l’Association du drone de l’industrie française (ADIF) in France, the Czech Unmanned Aerial Alliance, and several others in Asia including: the Korea Drone Association, Korea Drone Industry Association, the Japan UAS Industrial Development Association, and Shenzhen UAV Industry Association among others.

The formation of these drone associations is a good sign of a vibrant drone industry where drone companies have progressively established themselves in their national markets. By flourishing, they have given rise to drone associations which allow industry leaders to spread awareness of the benefits of drone technology and acquire more financial support for various projects. This has clearly boosted commercial drones in Germany and Switzerland. As the global drone industry continues to mature and regional markets consolidate, the rise of more of these associations will lead to more and better information about each country’s drone industry and their individual peculiarities.

Download our FREE Infographic: Commercial Drones in Germany and Switzerland 2021

This infographic “Commercial Drones in Germany and Switzerland 2021” shows a comparison between commercial drones in Germany and Switzerland based on bespoke studies for their drone associations.

Besides his financial oversight, Hendrik is an expert in aviation law and UAV regulation with more than 10 years of experience. Not only does he consult on all regulation questions, but Hendrik also writes the yearly drone investments report. Prior to launching DRONEII, at Lufthansa Technik he was the single point of contact to Civil Aviation Authorities (CAA) of Germany, Middle East and Asia.