- Regulation: The Key Driver of the Drone Industry

- Investments: Understanding the Financial Landscape

- Global Drone Market Status and Future Projections

- Top Remote-Sensing and Delivery Service Providers

- Leading Commercial and Dual-Use Drone Manufacturers

- Drone Utilization and Applications: Driving Innovation

- Industry Engagement: Annual Survey and Drone Events

- Eyes on Advanced Air Mobility

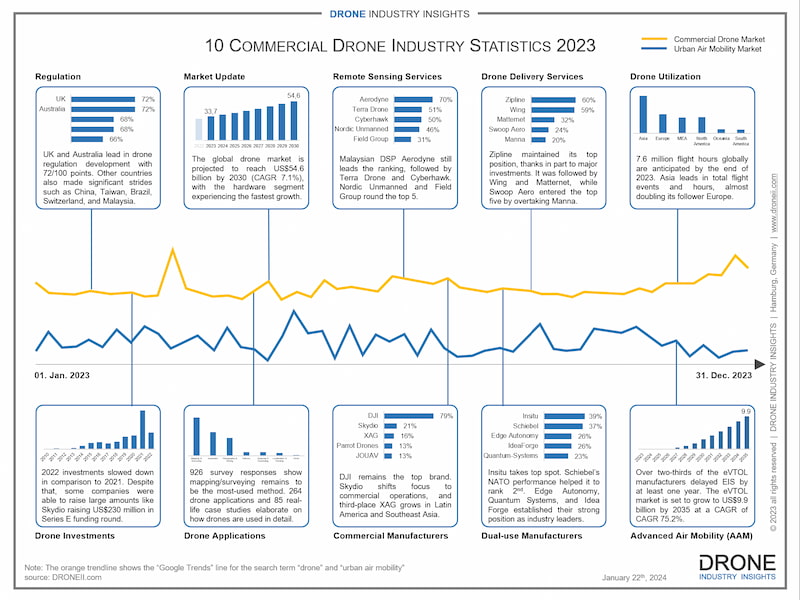

The Drone Industry's Journey Through 2023

The drone industry in 2023 experienced transformative changes, highlighted by significant regulatory shifts, technological advancements, and a growing global market. Much has already been written about the drone industry’s achievement in 2023. For a recap of the top stories by category, or a closer look at the 11 biggest news, feel free to check out the respective articles from our partners.

This year, we thought we would do something slightly different than previous years, so we are recapping some of our market data from the entire year while also integrating some of the big headlines from 2023 that are related to our research. We hope you enjoy the read!

Regulation: The Key Driver of the Drone Industry

For better or worse, the topic of regulatory frameworks and legislation is almost always at the top of the agenda when it comes to the global drone industry. At the start of 2023, the UK and Australia led our proprietary drone readiness index with a score of 72%, other countries also made significant strides such as China and Taiwan (+35) followed by Brazil, Switzerland, Malaysia (+31). This index scores countries on their work towards creating and implementing regulations that will enable large-scale and advanced drone operations, though it is worth emphasizing that it does not yet factor in regulatory processing (i.e. the country’s speed and efficiency for processing regulatory requests and applications).

Throughout 2023, many regulatory headlines were a promising sign for the industry, such as the entry into force of EASA’s U-Space framework, the first C6 rating in Europe to enable BVLOS under standard scenario in the specific category, the first Class1 UAS Type Certificate in Japan, four companies achieved FAA BVLOS approval in the USA, and the FAA delayed the Remote ID deadline until March 16, 2024 while also naming a new head of the Administration.

Investments: Understanding the Financial Landscape

Our annual review of investment patterns revealed that the value of total investments that the drone industry received in 2022 was US$4.8 billion, which signaled a decrease from 2021. And even though the annual review of 2023 has not yet been released, consider this a pre-release first look at the data: in 2023, the total value of investments (including all types of investments) was US$3.210 billion (stay tuned for much more detailed data coming in our annual investment databook!). Does this further decrease represent a bad signal for the industry? Certainly not, and here is why.

In perhaps the biggest investment headline of 2023, Zipline’s valuation increase to US$4.2 billion reflects investor confidence in the future of drone delivery. Meanwhile, Skydio raised US$230 million in Series E funding at the start of 2023, reaching a valuation of over US$2.2 billion and Spain’s Alpha Unmanned Systems completed its first investment round. In the world of publicly-traded drone companies, RED CAT subsidiary Teal Drones secured US$1.2M in funding. In conclusion, the decreased total amount of investments going to drone companies is neither a bad sign for the industry nor is there a lack of major investments taking place, especially for established companies with an established client base and strong revenue.

Global Drone Market Status and Future Projections

The drone market is projected to reach US$54.6 billion by 2030, with the commercial sector growing faster than the recreational one. Services dominate with nearly 80% of market activity, with the hardware segment experiencing the fastest growth. The Energy industry will continue to grow significantly, and drone mapping and surveying is currently a market worth US$10 billion that is also projected to grow very strongly. Drone deliveries, which continue to make headlines, are expected to grow globally at a rate of 13.9% CAGR, impacting sectors like healthcare, emergency services, and logistics. At the regional level, Asia remains the largest market for commercial drones, while the Middle East & Africa region is experiencing rapid growth.

Top Remote-Sensing and Delivery Service Providers

Malaysian Aerodyne continues to lead drone companies in remote sensing, expanding into the EU market through a strategic alliance with Aiview Group. Second place TerraDrone acquired majority shares of Unifly and Avirtech to enter the agricultural market, while Cyberhawk launched BVLOS operations using hydrogen fuel cell technology. The industry saw significant position changes, with Garuda Aerospace making a notable climb of 24 ranking spots into the top 10.

In drone delivery services, Zipline maintained its top position, thanks in part to major investments. It was followed by Wing and Matternet, while Swoop Aero entered the top five by overtaking Manna. Other drone delivery companies also managed to make plenty of headlines, such as Flytrex and Causey Aviation Unmanned receiving FAA’s Part 135 Air Carrier Certification to enable long-range, on-demand commercial drone delivery.

Interested in the Commercial Drone Market? Check Out Our Latest Drone Market Report!

Drone Market Report 2023

• 227-page drone market report featuring:

• Commercial drone market + recreational drone market

• Breakdown of data by: segment, industry, method, region, and country

• Additional chapters on regulation and rising technology trends

Leading Commercial and Dual-Use Drone Manufacturers

Not surprisingly, DJI remains the top brand. Despite some controversies, it announced that its drones have been used to rescue over 1000 people globally since 2013 and it also released several new products with plenty of fanfare. It is followed in the rankings by Skydio, which shifted its focus to commercial drones while expanding its customer base and securing the aforementioned investment. Third place, the Chinese XAG, has grown in markets like Latin America and Southeast Asia, which secured its rank among the market leaders.

Insitu is now the top dual-use drone manufacturer, with significant global partnerships while Schiebel’s performance in NATO exercises helped it climb the ranks into second place. Edge Autonomy, Quantum Systems, and IdeaForge rounded up the top 5 and established their strong position as industry leaders. Perhaps the biggest factor that will impact dual-use drone manufacturers’ ranking will be drawing the line between their commercial use, their government use, and the blurry line of pushing into mostly military use given their potential to impact the conflicts in Ukraine, Gaza, and other parts of the world.

Industry Engagement: Annual Survey and Drone Events

The 2023 global drone industry survey saw a record 1,113 submissions from 85 countries, a 25% increase from the previous year. Japan, the United States, and China had the highest rate of participation. The industry’s optimism has returned to a healthier level, with regulatory obstacles remaining a consistent concern, which highlights the importance of well-defined regulatory frameworks for industry growth.

In another exciting development, drone events are back in full swing. For Drone Industry Insights, this translated into keynote speeches and presentations at premiere events all around the world. Starting the year with the exciting Drone Show Korea (Busan, Korea) and the perennial Amsterdam Drone Week (Amsterdam, Netherlands), our team proceeded to present at the innovative Energy Drone & Robotics Summit (Houston, TX, USA) and the extravagant Drone World Congress (Shenzhen, China). The end of summer then brought the Scandinavian drone industry together at the International Drone Show (Odense, Denmark) as well as the global drone community meeting at the Commercial UAV Expo (Las Vegas, NV, USA). Finally, the presentation season then concluded with Interaerial Solutions (Berlin, Germany) and a digital presentation for Dronitaly (Bologna, Italy).

Eyes on Advanced Air Mobility

The Advanced Air Mobility (AAM) industry is set to grow into a market worth US$20.8 billion by 2035 at a CAGR (compound annual growth rate) of 22.1%. Perhaps this explains why so many events have reserved a unique spot for it on their agenda (or created an entirely new event), and why so many investment sums and headlines have gone into this segment of the drone industry.

In 2023, some major headlines for the future of AAM included Archer Aviation securing $215 million in funding from major stakeholders and acquitting a Special Airworthiness Certificate from the FAA for their Midnight eVTOL, Boeing taking full ownership of Wisk, Australia’s Civil Aviation Authority releasing vertiport guidelines, and Volocopter’s plans to offer services by the 2024 Paris Olympics, among a plethora of other headlines. Perhaps no other topic besides AAM could encompass the drone industry’s journey in 2023: big imagination created plenty of promise, and it is now becoming part of our daily reality.

Download our FREE Commercial Drone Statistics 2023 Infographic

This Infographic shows some key developments in the drone market in 2023. Over the course of 2023, the drone market experienced several key moments, and the infographic shows some of the latest research alongside the search trend line for the keyword “drone”.

Besides his financial oversight, Hendrik is an expert in aviation law and UAV regulation with more than 10 years of experience. Not only does he consult on all regulation questions, but Hendrik also writes the yearly drone investments report. Prior to launching DRONEII, at Lufthansa Technik he was the single point of contact to Civil Aviation Authorities (CAA) of Germany, Middle East and Asia.

- 1 Regulation: The Key Driver of the Drone Industry

- 2 Investments: Understanding the Financial Landscape

- 3 Global Drone Market Status and Future Projections

- 4 Top Remote-Sensing and Delivery Service Providers

- 5 Interested in the Commercial Drone Market? Check Out Our Latest Drone Market Report!

- 6 Leading Commercial and Dual-Use Drone Manufacturers

- 7 Industry Engagement: Annual Survey and Drone Events

- 8 Eyes on Advanced Air Mobility