Who are the Top Drone Investors?

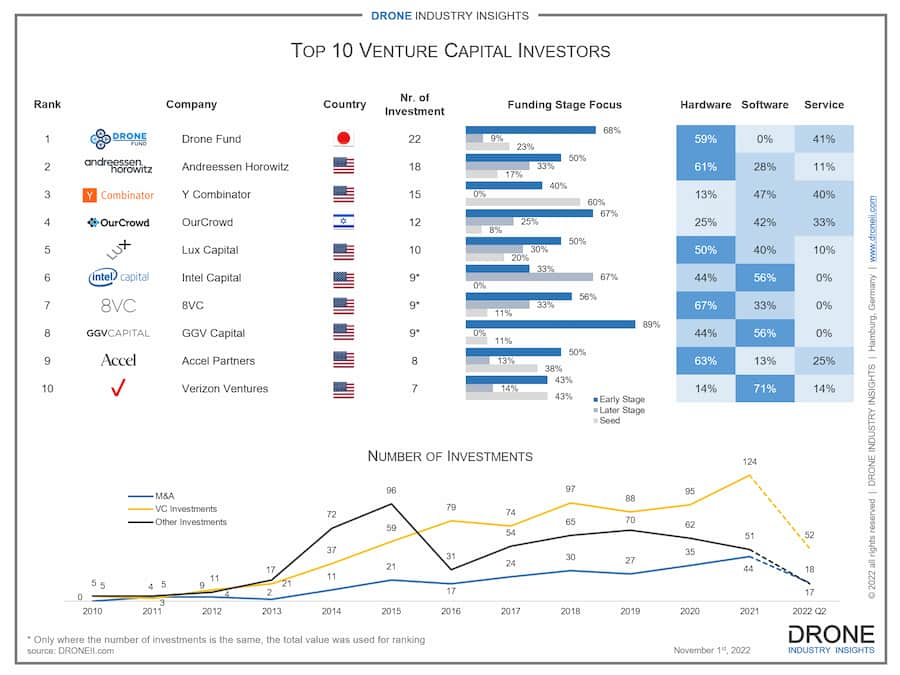

Drone investments have been breaking records for the past decade, yet who are the top drone investors behind them? As a complement to our Drone Investment Database, we selected the top 10 venture capital investors based on the number of investments since 2010. To be clear, these top drone investors are not ranked in terms of investment value, meaning that the investor ranked in first place has the highest number of investments rather than total value.

Profile of the Top Drone Investors

The top drone investor over the past decade has been Drone Fund, with a total of 22 investments. This company is based in Tokyo, Japan, and recently celebrated their 5th anniversary. Drone Fund invests exclusively on drone startups and has shown a strong interest in air mobility. As can be seen in the infographic, the vast majority of their investments go into early-stage funding (68%). In addition to investments, they also provide operational support, collaborative planning, and regulatory assistance to drone companies.

In second place out of all top drone investors we find Andreessen Horowitz. This venture capital firm located in Silicon Valley, California and they engage in different stages of funding, with around half of their 18 total [drone] investments going into early-stage funding. In addition to drones, Andreessen Horowitz invests on technology companies in different areas such as consumer, enterprise, bio/healthcare, crypto, and fintech spaces.

Rounding up the top 3 drone investors we find the American technology accelerator Y Combinator, founded in 2005. Their 15 drone investments have gone exclusively to seed or early-stage funding. Since their founding, they have invested in nearly 3,500 companies including Airbnb, DoorDash, Stripe, Instacart, Dropbox, and Coinbase. They offer different programs like YC batch program, YC growth program or YC Continuity which support startups throughout their life of their companies.

Overall, 8/10 of the top drone investors are from the USA, the other two are from Japan and Israel. It is worth noting that in our rank, only the investors with identical number of investments are then ranked based on their total investments value. This means that even though the overall rank doesn’t consider value, Intel Capital, 8VC and GGV Capital all had 9 investments, but Intel had a higher investment value and is therefore ranked above 8VC, who is in turn ranked higher than GGV Capital.

Read more about our due diligence and investment-support services!

Financial Services for Drone and Non-drone professionals

Drone Industry Insights provides commercial due diligence, business model assessment, credit risk research and other critical insights for investors who need to anticipate and mitigate potential risks in order to make informed investment decisions.

Segment Focus by the Top Drone Investors

In which drone segments do the leading investors put their money? What is clear is that hardware segment receives more funding by top drone investors in comparison with other segments. Hardware received a substantially large share of total investment (around 70%) from all investors worldwide. Drone service companies come in second place with around 17%, followed by software companies with roughly 14% of total investment. It is worth mentioning that these percentages are not shown on the infographic. Although the top investors seem more focused on software than services, there is a stronger focus overall on services when we look at the total number of investment deals.

The strong preference for hardware is hard to deny. Half of the top drone investors focused more on hardware drone companies than on the others. For instance, the top two investors, Drone Fund and Andreessen Horowitz, dedicated around 60% of their investments to Hardware companies. However, individually there were other investors who focused more on software companies. These include Intel Capital (56%), GGV Capital (56%), and especially Verizon Ventures, who seems to have a special affinity to software investments which make up 71% of their total drone investment portfolio.

Finally, the focus of leading investors was not much on drone service companies. The highest percentage belongs to Y Combinator, which allocated 40% of their investments into service companies. However, this was still secondary to their investment into software (47%). Overall, our findings regarding drone jobs confirm the development specifically in Hardware workforce, since this segment posted the highest number of drone jobs in comparison with companies in the service and software segments.

Which Investments do Top Drone Investors Prefer?

When looking at the “Funding Stage Focus”, the data indicates that the focus by most of the top drone investors is on the early stage. Nevertheless, some investors like Y Combinator invested more on seed stage (60%), while others like Intel Capital preferred later stage funding (67%). If we consider all the investments since 2010 that went into drone companies, 54% of total investment deals were on early-stage funding. This is perhaps because there are many new startups entering this ever-growing global industry.

In the lower part of the infographic, we can see the total number of investments and which category they fit into. The graph indicates the number of investments from 2010 until Q2 2022 and splits them into 1) Venture Capital Investments, 2) Mergers & Acquisitions (M&A) and 3) Other Investments (for instance: Initial Public Offering (IPO), Private Investment in Public Equity (PIPE), Grants, etc.)

The number of venture capital investments has increased over the years, and they reached the highest number in 2021, which was a total of 124 investments. Although it seems that 2022 will not break the record set in 2021, the 52 VC investments that have taken place through the first half of 2022 is still on path to outpace every year before 2018.

Regarding the other two types of investment, the number of M&As has steadily increased over the past decade, reaching its highest total (44) in 2021. The number of M&As in the first half of 2022 (17) is an encouraging sign that this pattern of increasing consolidation will continue, which will hopefully allow more and more companies to scale their operations. Lastly, though the number of “Other Investments” is far below its peak of 96 in 2015, it is quite likely that these other types of investments have been replaced by more traditional VC Investments and M&As that have continued to grow.

To find out more about all investments that have taken place over the past decade, as well as the top drone investors, investment regions and beneficiary companies, check out our Commercial Drone Investment Database. If you are an investor, work at an investment firm who may be interested in drones, or are a drone company looking for investments, read more about our Financial Services. Among our most popular offerings is a matchmaking service between drone companies and investors, so have a look and get in touch!

Download our FREE Top Drone Investors Infographic

This infographic, “Top Drone Investors”, which shows the top 10 VC investors since 2010 as well as investment deals until Q2 2022

Besides his financial oversight, Hendrik is an expert in aviation law and UAV regulation with more than 10 years of experience. Not only does he consult on all regulation questions, but Hendrik also writes the yearly drone investments report. Prior to launching DRONEII, at Lufthansa Technik he was the single point of contact to Civil Aviation Authorities (CAA) of Germany, Middle East and Asia.