11 min read · Created: 2018-04-17 · By Hendrik Boedecker

The Drone Investment Trends 2018

Drone investment trends 2018: Drone investment trends are strong indicators to predict the future of the drone industry. The low price of drones and ability to carry sensors, quickly triggered adoption throughout many industries. Meanwhile, the commercial drone market created an entire eco-system attracting large investments. Besides hardware (drones, sensors, ground station, etc.), software solutions and services are also part of it. Since technology advanced quickly over the last five years, drones are now able to carry large weights opening a completely new sector: autonomous aerial taxis (AAT). Another branch is keeping security sensitive areas safe by detecting, localizing and intercepting rogue drones (also known as counter-UAV or CUAV).

The unique approach to decipher the mechanics of this dynamic market – detached from top-down market models – allows extrapolating investment trends and perspectives at a high level of precision. The report addresses the leading market players’ investment deals and trends that will influence the development of the commercial drone market. In total, 44 key industry players and investors are highlighted in detail – all investment deals are segmented by region, sector and cluster.

To create a better understanding of the market dynamics, it is important to understand the mechanics driving it. Maintaining competitive capability and a clear view of the market development is just as important as strategic partnerships. In some cases, products/companies occupy a very important strategic role, putting them into the spotlight for acquisitions. There are overall developments in terms of cluster (hardware, software, service) and region – everything apportioned in the report in detail.

“This report elaborates on all major and minor developments, highlighting the driving factors behind each sector – based on actual data.”

Key questions addressed

- What is the current investment situation value per sector and cluster?

- How and why did the market change and where is it heading?

- Who are the key players and investors in the commercial drone market?

- How does the software sector influence the overall market?

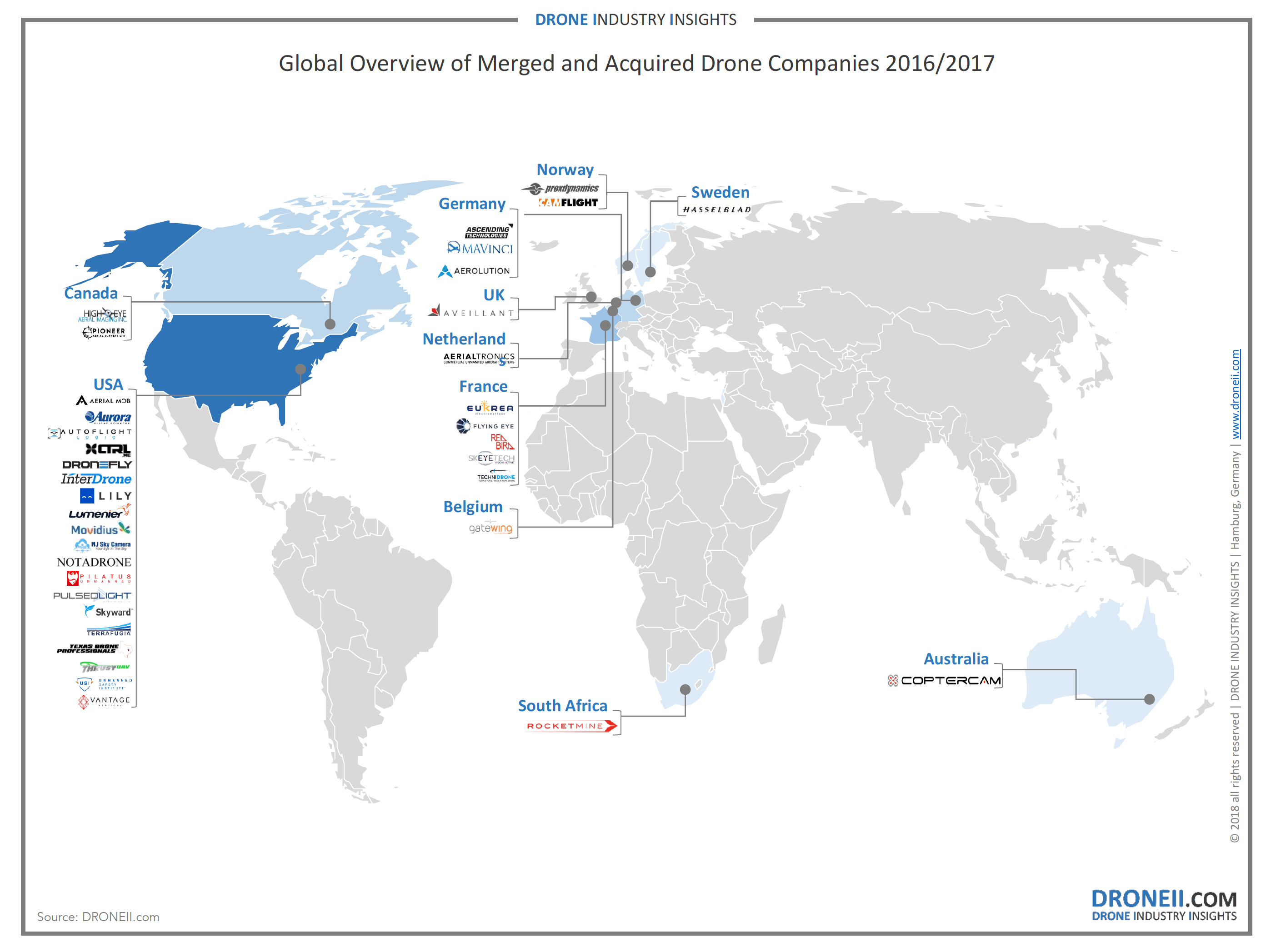

- Where lies the focus in mergers and acquisitions?

- What are the driving factors behind the current strategic partnerships?

The report is essential for

- Drone/UAV manufacturers

- Investors

- Component and system manufacturers

- Software and application developers

- Systems integrators

- Industry organizations and associations

- Government agencies

- Investor community

- Founders

NOTE: This Report is not available anymore. Please refer to the updated Report: Drone Investments Report 2020

The Drone Investment Report 2019

-

Since 2008, $3,163B have been invested into drone companies

-

2018 was yet another record year with $702 million total invested through 159 investment deals

-

Since 2014, the total and annual global investment value has been growing at a constant level of 23% CAGR

Besides his financial oversight, Hendrik is an expert in aviation law and UAV regulation with more than 10 years of experience. Not only does he consult on all regulation questions, but Hendrik also writes the yearly drone investments report. Prior to launching DRONEII, at Lufthansa Technik he was the single point of contact to Civil Aviation Authorities (CAA) of Germany, Middle East and Asia.