New Patterns in Drone Company Funding

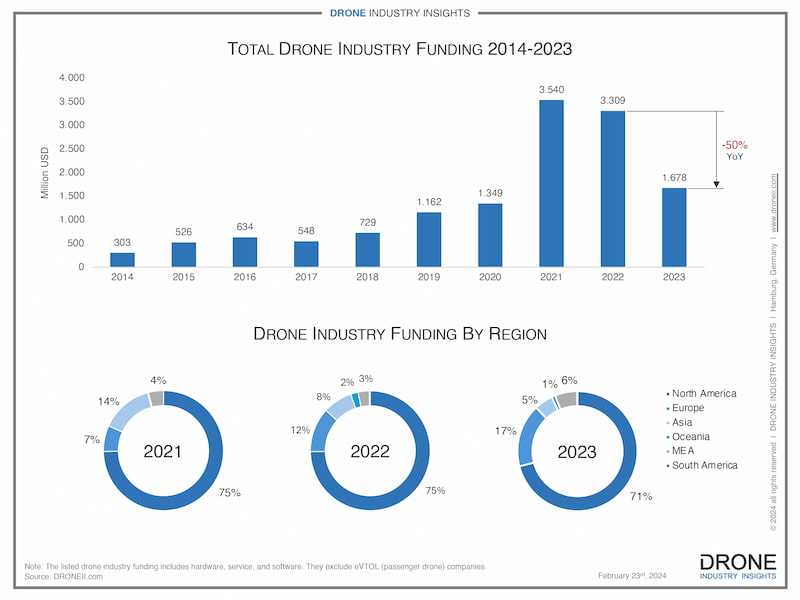

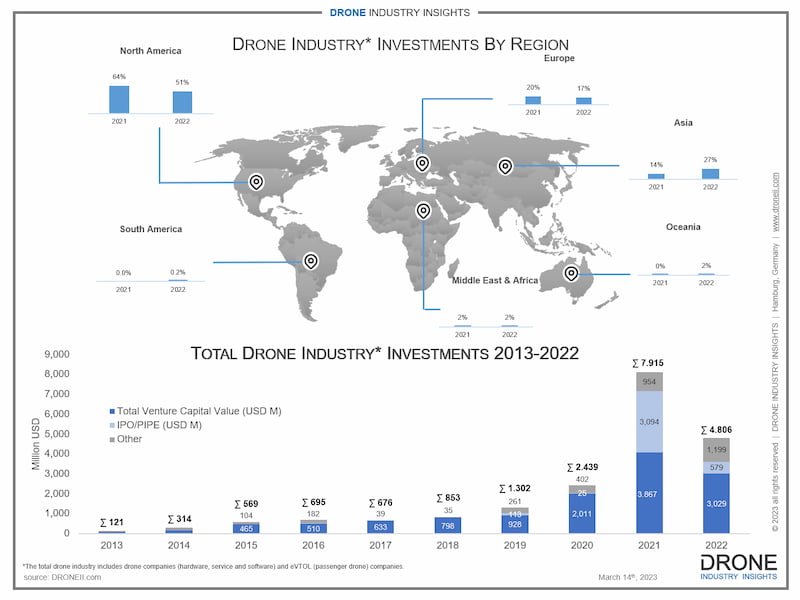

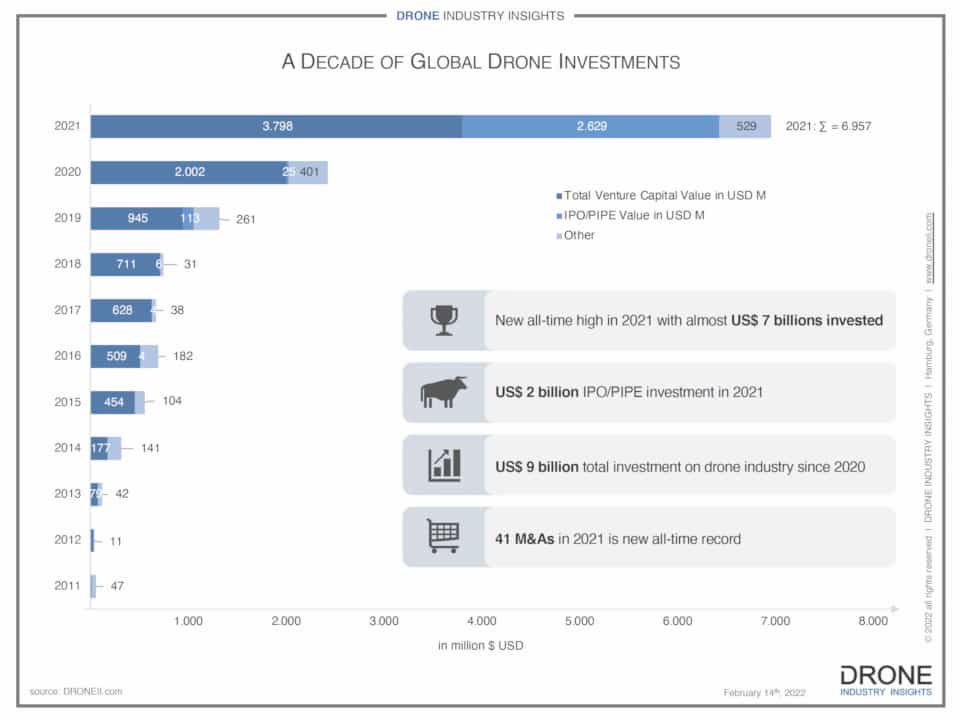

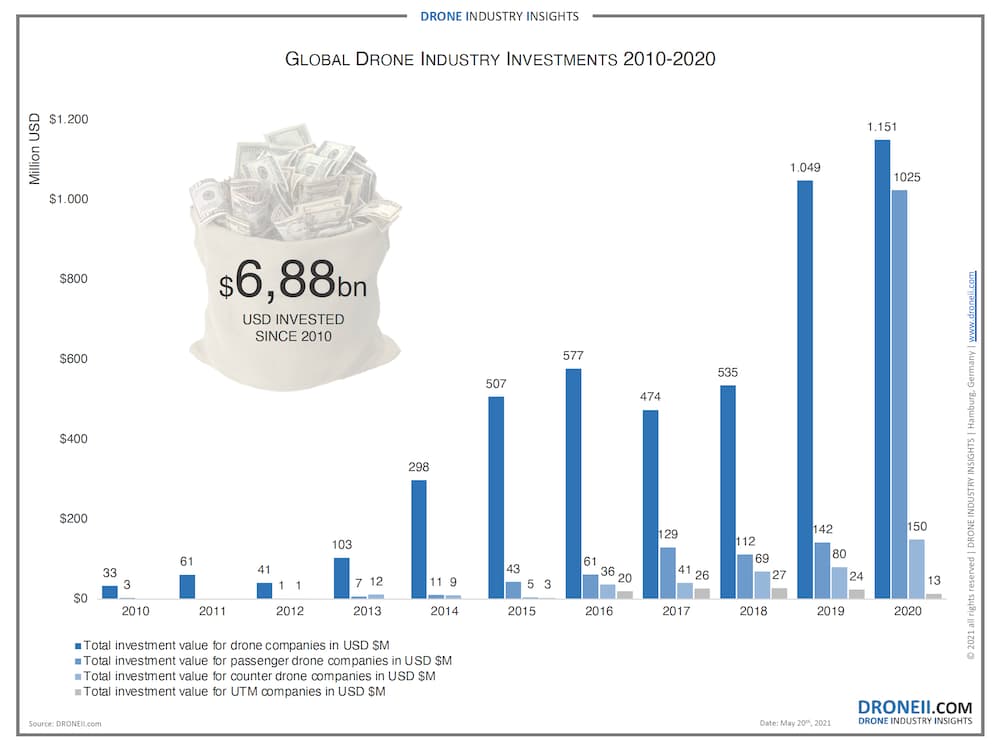

For a number of years, drone company funding shattered records on a yearly basis. A quick look at our investment infographics reveals that the amount of money doubled twice, from 2019 to 2020 and from 2020 to 2021. This, however, stopped in 2022, when both the total funding value and the number of funding deals involving drone companies decreased for the first time. And now, in 2023, the cumulative total of drone company funding around the globe in 2023 was US$1.7 billion. The number of funding deals decreased by a small amount, but the total value decreased significantly.

Before we begin a closer analysis, there is one important clarification: when comparing the 2023 data from the blogs and infographics of previous years, the methodology has now separated drone company funding from AAM/eVTOL funding. The amount of money being pumped into these topics was a major boost factor in 2020 and 2021, which made the entire drone industry total climb exponentially higher, and these have therefore been excluded from the analysis below.

A Closer Look at Drone Company Funding Patterns

As the infographic above shows, drone companies in 2023 received US$1.7 billion, but this represents half the total amount that they received in 2022 (US$3.3 billion). After seeing drone company funding more than double between 2020 and 2021, it has now decreased in 2022 and been cut in half in 2023 (-49%). Is this an anomaly or a trend? Was there a bubble that has now burst? Let’s have an in-depth look at the new patterns in drone company funding and why it might not be all bad news for the industry.

Perhaps the biggest factor for the diminished drone company funding boils down to a common issue: growing past the startup stage. The value of later-stage venture capital investments has decreased considerably, and this has happened not only in the drone industry. So at this stage, even if a drone company has developed its product, proved that there is a market opportunity, and has meaningful revenues, the latest global financial trends show that there is now a lower chance of receiving further [substantial] investments. And what about the companies that make it past this stage?

The value of IPO and post-IPO deals increased to more than double, which was certainly a strong sign for companies that entered financial markets around the globe. However, the number of IPO/post-IPO deals decreased in comparison with last year. So on the one hand, fewer companies benefitted from these deals, but on the other hand, the ones who benefitted did so greatly. Therefore, it is hard to describe this as either a positive or a negative development and it simply remains an observation to consider.

Drone Company Funding by Region and Industry Segment

The regional distribution of drone company funding shows that North America received 71% of the global total. This was thanks in particular to major investments in companies like Zipline and Skydio, which received the highest investments of 2023. North America was followed by Europe (17%), then the Middle East and Africa (MEA) region (6%), and Asia (5%). In terms of general patterns, North America has always received the highest, but its share has decreased since 2021 (75%). Europe’s share has continued to increase from 7% in 2021 to 12% in 2022, and now 17% in 2023. Asia’s share has decreased from 14% in 2021 to 8% in 2022 and now 5%. The other Region worth noting is the Middle East and Africa, which has fluctuated from 4% in 2021, down to 3% in 2023, but elevated to a new high of 6% in 2023, surpassing Asia to take third place.

Much like in previous years, there was a higher percentage of investments allocated to drone hardware companies. As mentioned in other blogs, this is likely a pattern that will continue to endure given the high entry cost of manufacturing drone platforms. At its core, the drone industry combines robotics and aviation, which are high-cost industries given the price of chips, lenses, materials, and any number of other inputs, not to mention the price of testing and repairs to ensure safety. After hardware, drone service companies received more funding than drone software companies, which flips the pattern from 2022.

Want to Know More About Drone Industry Investments in 2022 and Beyond? Check Out Our Latest Drone Investment Database!

Drone Investments Database 2023

• 41-page Summary + 2 Databases (Drone Investments + AAM Investments)

• List of 1,680+ drone investments, 1,200+ partnerships, and 15 drone stocks

• List of 130+ AAM investments, 260+ partnerships, and 8 AAM stocks

• Breakdown of investments by market segment and region

Drone Partnerships, Mergers & Acquisitions in 2023

Similar to drone company funding, the number of mergers and acquisitions (M&As) in the drone industry reduced to almost half the quantity. Since 2021, the number of M&As has shown a decreasing pattern from 47 in 2021, to 42 in 2022 to 22 in 2023. But it is worth noting that the value of M&As in the drone industry more than tripled, meaning that there were much bigger deals even if there were fewer M&As in total.

In terms of partnerships, the grand total number of partnerships including AAM-related partnerships rose to 320 (from 275 in 2022). However, non-AAM drone company partnerships decreased slightly from 208 in 2022 to 195 in 2023. Nevertheless, this decrease is rather negligible, and the more important upshot is that drone companies continue to form partnerships in large numbers to improve their businesses.

Most partnerships in the drone industry were between drone companies and non-drone companies. This is a pattern that has continued over the years and represents a strong sign for the industry. By forming these partnerships, drone technology can have an impact on new markets while non-drone companies can benefit from working with drone professionals rather than attempting to start their drone operations. Interestingly, the share of partnerships between two or more drone companies also increased this year. In other words, the industry continues to be active in seeking new and mutually beneficial collaborations.

What to Make of These New Drone Financial Trends

Although there is no single explanation for the downward trend in drone company funding, there are a lot of factors that may be having a negative influence. From geopolitical developments, supply chain concerns, inflation, and cautious investors, it is likely a combination of these rather than one major culprit. High interest rates might arguably be playing the biggest role, since they draw investors towards more traditional investment markets rather than investing in new technologies or even in drone stocks. Moreover, slow regulatory progress around the globe has likely forced some companies to shut down, leading to erosion of some investors’ trust.

And yet there are nevertheless good reasons for optimism. The economic shocks and major financial impact of the COVID-19 pandemic in 2020-2021 led to astoundingly high investments in drone technology (where investment values more than doubled). But if these outlier years are factored out, drone company funding would still show a continuous upward trend since 2017. Moreover, deep technologies such as artificial intelligence and machine learning are trending upward at an incredible rate, and these have a direct impact on drone technology. Perhaps these will also create a unique opportunity to invest in drone companies much like the pandemic did, except this time the regulatory progress will also be more palpable.

Download our FREE Drone Company Funding through 2023 Infographic

This infographic, “Drone Company Funding through 2023”, shows investment trends in the drone industry from 2014 until 2023. It also features a regional breakdown of the past 3 years.

Zahra Lotfi is a market research analyst with a Ph.D. in economics (focus on innovation) and a Master degree in Business Administration (focus on international marketing)

Zahra Lotfi is a market research analyst with a Ph.D. in economics (focus on innovation) and a Master degree in Business Administration (focus on international marketing)