Insights from the Global Drone Industry Survey

It is finally time to share some insights from the latest global drone industry survey. This year, the response count soared to a record of 1,113 submissions, which represents a significant 25% leap from the previous year’s count of 891. This increased participation points to a growing industry interest in sharing insights and experiences, as well as in fostering a sense of collaboration and knowledge exchange. In this regard, we would like to begin this article by who helped us distribute the survey and collect a record number of responses.

Delving into the data, the surge in participation isn’t confined by geographical boundaries or clusters of participants. The survey drew contributions from drone companies in 85 countries, surpassing the previous year’s mark of 81 countries. In terms of the highest rate of participation, the top three countries were Japan, the United States, and China, which accounted for 228, 157, and 81 responses, respectively. Particularly noteworthy is the collective weight of the top 10 countries: this year they represented only 65% of the total responses (a decrease from 71% in 2022), which suggests that the global drone industry survey is indeed reaching all corners of the world beyond the traditional market strongholds.

Drone Industry Data: Unveiling Key Trends and Insights

The drone industry, characterized by its dynamic landscape, is a tapestry of drone companies of various sizes. It remains true that most drone companies around the world have under 50 employees. Yet an intriguing facet of this year’s survey is the representation of over 45 companies that boast more than 5,000 employees. This shows that the industry is certainly not “only DJI” and that there are dozens of large companies operating daily within the global drone industry.

All in all, this data underscores the industry’s versatility in fostering entities of diverse sizes. While smaller entities have historically contributed to the industry’s narrative, this year’s survey has succeeded in capturing the perspectives of larger corporations.

Find out more about what drone industry professionals said in our FREE annual drone industry survey report!

Global Drone Industry Survey (Barometer) 2023

• 1,113 responses from 85 countries

• Top responses from Japan, the USA, and China

• Insights on company size, focus, reasons to adopt drones

• Year-to-year comparison on optimism, top priorities and more!

Mapping the Skies: Spotlight on Dominant Drone Applications

The global drone industry survey brings to light a compelling narrative regarding the role of Mapping & Surveying within drone application methods. This year, this method claims a commanding 37% share among Business-Internal-Service (BIS) companies and a 33% share among Drone Service Providers (DSPs). The emergence of Mapping & Surveying as a cornerstone application method reflects the industry’s shift toward data-driven solutions.

Meanwhile, Photography & Filming maintains its significance, accounting for 31% of BIS activities and 27% of DSP engagements. This underscores the diverse range of applications fueling the drone industry’s growth. Finally, the global drone industry survey data reveals a discernible contrast in application preferences between DSPs and BIS companies when it comes to the Inspection method. DSPs demonstrate a distinct preference, allocating a substantial 25% share to this application, whereas BIS companies allocate 16%. This divergence might suggest that carrying out drone inspections requires enough time, resources, and/or expertise to be sold/bought as a service rather than carried out internally, though this is of course only one way to interpret the data.

Balancing Expectations and Reality

The interplay between expectations and experienced reality has been one of the more interesting metrics over the lifespan of the global drone industry survey. The expectations score reached its pinnacle at 7.2 in 2021 but has since leveled off at 6.6 in 2023. In contrast, the reality score experienced a journey of fluctuation from 6.0 in 2020 to 5.6 in 2021 and rebounding to 5.9 in 2022 before stabilizing at that same level in 2023.

In a nutshell, it could be said that expectations and reality converged from 2018 until 2020, at which point the pandemic led to extreme optimism for a recovery in 2021, which did not materialize and led to disappointment in 2022. In 2023, the optimism is back but at a much healthier and less extreme level. These scores provide insight into the industry’s cautious optimism and its adeptness in navigating the ebb and flow of external factors such as the global pandemic and inflation over the past years.

Navigating Industry Challenges: Regulatory Considerations

The drone industry, like any dynamic sector, grapples with its share of challenges. Regulatory obstacles, which consistently feature as a recurring concern within the survey responses, underscore the industry’s reliance on well-defined regulatory frameworks. As the industry continues to evolve, these frameworks serve as guiding principles, shaping the trajectory and growth of the drone ecosystem. Therefore, it is no surprise that once again the top market-driving factor is considered to be rule-making authorities. In short: regulation represents both the biggest challenge and the biggest growth factor.

More Insights from the Global Drone Industry Survey

These are some of the key insights found within the latest edition of the free annual white paper. However, the report itself features more insights such as a list of all the top 10 participating countries and a map of all countries that participated. Additionally, you will find more details on the top reasons to adopt drones, a breakdown of the optimism levels within sub-segments, and a ranking of the top challenges that professionals foresee for the industry as a whole.

Finally, as a thank you to all participants and partners, this year we will also begin a series of articles digging deeper into the data from some of the top drone countries and regions who provided responses to the global drone industry survey. Stay tuned for these articles, and we cannot wait to see what the survey data reveals next year and beyond.

Download the FREE Global Drone Industry Survey Infographic

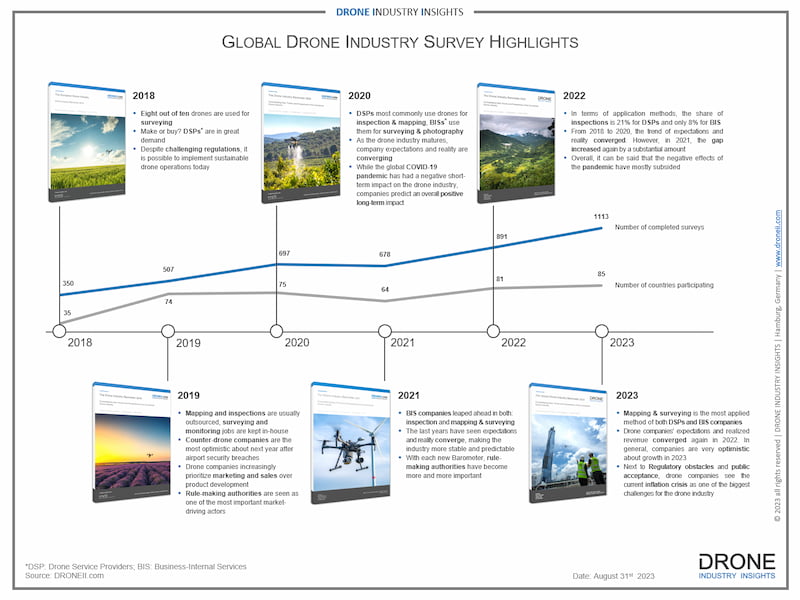

The drone industry survey Infographic provides a timeline of the 6 years since the foundation of this leading survey. The infographic shows some of the key takeaways from each year as well as the number of participants and countries represented in each year’s survey.

Besides his financial oversight, Hendrik is an expert in aviation law and UAV regulation with more than 10 years of experience. Not only does he consult on all regulation questions, but Hendrik also writes the yearly drone investments report. Prior to launching DRONEII, at Lufthansa Technik he was the single point of contact to Civil Aviation Authorities (CAA) of Germany, Middle East and Asia.

- 1 Drone Industry Data: Unveiling Key Trends and Insights

- 2 Find out more about what drone industry professionals said in our FREE annual drone industry survey report!

- 3 Mapping the Skies: Spotlight on Dominant Drone Applications

- 4 Balancing Expectations and Reality

- 5 Navigating Industry Challenges: Regulatory Considerations

- 6 More Insights from the Global Drone Industry Survey