Survey Snapshot: The DACH Regional Drone Market

Note: The following information about drone companies in the DACH Region (Austria, Germany, Switzerland) is based exclusively on data from our latest drone industry survey and is not a comprehensive drone market study. Therefore, it should be interpreted as a glimpse into the DACH regional drone market rather than in-depth authoritative research. For a more thorough study, please contact info@droneii.com

For the third installment of our country market series, we bring you a special edition focused on an entire region: the DACH Regional drone market. In case you are unfamiliar, the name DACH stands for the abbreviations of Germany (DE for Deutschland), Austria (A), and Switzerland (CH, for Confoederatio Helvetica). Thanks to a common language, this German-speaking part of Europe has achieved a high level of integration and cross-border collaboration in several industries. In addition, all three countries have vibrant economies with a high emphasis on technological development, which bodes well for the development of commercial drones in the DACH region.

Opportunity for Drones in DACH

By measure of real GDP, these countries rank 5 (Germany), 35 (Switzerland), and 44 (Austria), but it is worth noting that in terms of real GDP per capita, they would all rank in the global top 30 (Switzerland – 9, Austria – 24, Germany – 26). All of this means that these countries have highly developed economies with the money to invest in the latest drone technology, which is why we also find plenty of drone companies in the DACH region.

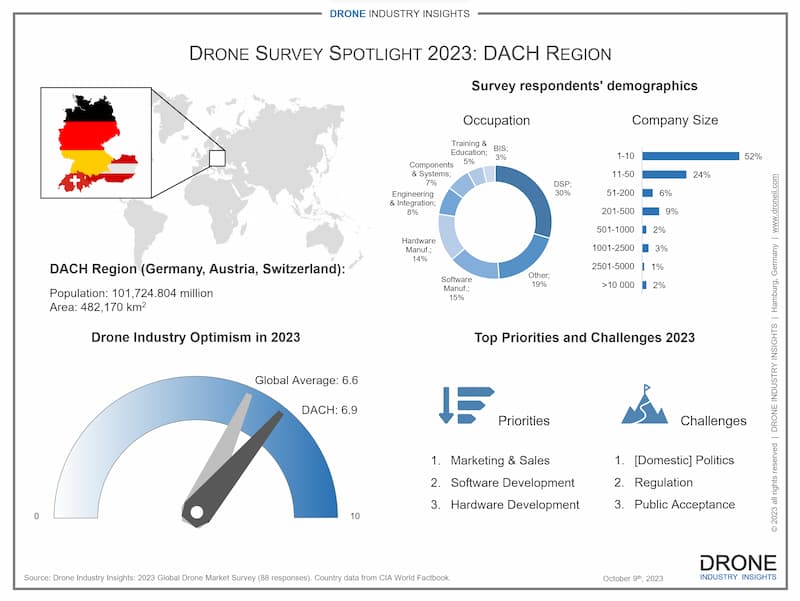

The DACH region has a population of 101.72 million inhabitants within an area of 482,170 square kilometers. Geographically, the area is covered with plenty of mountains and lakes which not only make for great drone photography but also provide an opportunity to eventually use delivery drones instead of having to drive around the lakes or over the mountains.

In terms of activities that are already happening with commercial drones, there are already several companies carrying out drone surveys and inspections in the energy industry, or mapping of construction projects and there are also projects testing out drone deliveries in major cities like Hamburg, Germany (over 2 million residents) or Zurich, Switzerland.

* All country data from the CIA World Factbook

DACH Regional Drone Market Composition

The DACH regional drone market is very startup-driven, whereby 52% of companies have 1-10 employees and another 24% have 11-50 employees. This means that a vast majority of over 75% of companies are smaller than 50 employees, while only 8% of DACH drone companies have more than 500 employees. Although this may seem like an extremely high and unsustainable amount of small companies, the DACH region as a whole has over 70,000 startups, meaning this is part of the culture rather than a drone-industry-specific observation.

Drone companies in the DACH region act primarily as Drone Service Providers (30%), meaning that a lot of these start-ups have found innovative ways to provide drone solutions in various industries throughout the region. Officially, the second most common type of company are Software Manufacturers (15%), closely followed by Hardware Manufacturers (14%). The “Other” category (19%) consists mainly of consulting, research and media companies, but some other top activities with their own category are Engineering & Integration (8%), Components & Systems (7%), and Training & Education (5%).

In comparison with other countries that we have covered in our series, it is interesting that there is a strong balance between producing drone hardware, software, and providing services. This alone makes the DACH drone ecosystem rather sustainable since 59% of companies work in one of these areas and therefore can provide their products to others without much need for the hassle and cost of imports from other countries. Moreover, based on the survey data, roughly two-thirds of drone companies in the DACH region are members of a drone association. This means they are likely to be aware of and able to capitalize on collaboration opportunities.

Interested in the Commercial Drone Market? Check Out Our Latest Drone Market Report!

Drone Market Report 2023

• 227-page drone market report featuring:

• Commercial drone market + recreational drone market

• Breakdown of data by: segment, industry, method, region, and country

• Additional chapters on regulation and rising technology trends

Priorities and Challenges for Drone Companies in the DACH Region

The top priorities for the DACH regional drone market also align rather well with its market composition. Much like the rest of the world, the top priority currently is marketing & sales. This is followed by software development and then hardware development, which fits well with the aforementioned most common activities in the region. Meanwhile, the top market-driving factors according to DACH drone companies are considered to be: drone manufacturers, rule-making authorities, and DSPs/operators. The importance of manufacturers corresponds well with the market composition and priorities, but the topic of regulation is worth a closer analysis.

DACH region’s drone companies considered regulation the second biggest industry challenge (after domestic politics). However, many survey participants expressed several issues regarding regulation including a lack of harmonization, slow approval processes, and even so far as referring to “strangulating regulation”. Moreover, the average company in the DACH regional drone market perceived a rather negative development when it comes to regulation (score of 4.7, where 5 is neutral). Therefore, the importance and concern regarding regulation in the region should not be underestimated.

DACH Drones: Optimism Despite Challenges

And yet, despite the somewhat negative perception and high concern for regulatory issues, drone companies in the DACH region remain slightly more optimistic than the rest of the world (6.9 vs 6.6). They are also considerably more optimistic than they were in 2022 (6.0), which demonstrates the overall positive trajectory and drive for innovation within all three countries.

All things considered, the DACH region presents fertile ground for the drone industry, characterized by startup agility and robust collaboration among service providers, software, and hardware producers. This synergy fosters a sustainable and self-sufficient market, ready for significant expansion despite existing regulatory challenges. With evolving regulatory landscapes, the DACH regional drone market is not only self-sustainable but also enjoys major innovation and global market influence. By navigating regulations and leveraging the vibrant entrepreneurial spirit in the DACH region, the drone industry is poised for unprecedented growth and innovation in Germany, Austria, and Switzerland.

Stay tuned as we continue to feature more countries and regions with unique and exclusive data from our annual Drone Industry Survey. If you are interested in learning more about the global drone market, you can find detailed data by sector, industry, method, region, and country in our flagship Drone Market Report.

And if you are interested in all the ins and outs of a particular region or country, including information on individual companies, you can contact us to discuss a comprehensive drone market study. Please contact info@droneii.com with the subject “Customized Drone Market Research”.

Download our FREE Drone Companies in the DACH Region Infographic

Our Infographic about drone companies in the DACH region shows a market breakdown of what drone companies do, their size, top priorities and challenges. It also features an optimism meter comparing drones in DACH with the rest of the world.

Besides his financial oversight, Hendrik is an expert in aviation law and UAV regulation with more than 10 years of experience. Not only does he consult on all regulation questions, but Hendrik also writes the yearly drone investments report. Prior to launching DRONEII, at Lufthansa Technik he was the single point of contact to Civil Aviation Authorities (CAA) of Germany, Middle East and Asia.