Survey Snapshot: the South African Drone Market

Note: The following information about drone companies in South Africa is based exclusively on data from our latest drone industry survey and is not a comprehensive drone market study. Therefore, it should be interpreted as a glimpse into the South African drone market rather than in-depth authoritative research. For a more thorough study, please contact info@droneii.com

Make no mistake: despite a lack of international headlines, the African continent is a hotspot for drone technology. In this 5th installment of our drone country market series, we begin to shed light on the continent’s drone innovation by highlighting the South African drone market.

Drones are being used in several parts of Africa such as outsmarting desert locusts in Kenya, managing quelea bird infestations in Zimbabwe, or maritime monitoring in Nigeria and Seychelles. In South Africa itself, there was a recent headline about drone use taking off in the country, which mentions fire-fighting, mining, and crime management among others. Rather than explaining particular use cases and companies, the text below provides a glimpse into the South African Drone Market as a whole.

Opportunity for Drones in South Africa

With a population of around 58.048 million residents, South Africa is in fact among the most populated countries in the continent (though official census numbers put the population closer to 62 million). But it nevertheless pales in comparison to Nigeria (over 200 million), Ethiopia (over 116 million), and Egypt or the Democratic Republic of the Congo (both roughly over 100 million).

Yet its area of 1,219,090 sq km with plenty of mountains, rivers, and access to the sea provides ample opportunities for drone technology to shine. With a real GDP of US$790.625 billion (similar to Colombia and higher than Switzerland or the United Arab Emirates), it is wealthier than other countries in the region, which should allow it to become a leader in drone technology.

In addition to drone use in top industries such as agriculture or construction, another great opportunity for drones in South Africa could stem from its 20,986 km of railways (global rank 13). This provides an opportunity for drone inspections, which several drone companies in various other parts of the world have also taken on. So, all things considered, the population, relative wealth, and overall economy and geography provide plenty of room for the South African drone market to flourish.

* All country data from the CIA World Factbook

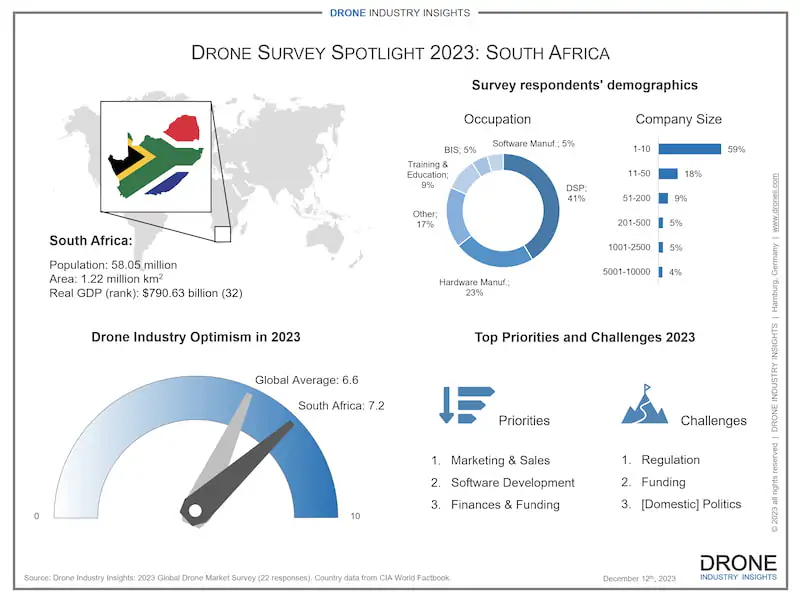

South African Drone Market Composition

When it comes to the drone companies in South Africa that are already active, what do they do? Roughly 60% of South African drone companies are small operations of 10 employees or less, and almost 80% have a workforce of 50 or fewer employees. In other words, this is a very startup-and-SME-driven ecosystem, and perhaps even more so than the already startup-driven global drone industry.

Naturally, 41% of the South African drone market consists of drone service providers. However, an interesting 23% are hardware manufacturers, and there is a growing share of Drone Training & Education companies (currently around 9%). With these components alone, there is a solid base for the country to develop a good drone ecosystem thanks to having hardware, services, and training. Other types of drone companies in South Africa include BIS (Business Internal Services, 5%) which use drones in-house, Software Manufacturers (5%) and various others.

Interested in the Commercial Drone Market? Check Out Our Latest Drone Market Report!

Drone Market Report 2023

• 227-page drone market report featuring:

• Commercial drone market + recreational drone market

• Breakdown of data by: segment, industry, method, region, and country

• Additional chapters on regulation and rising technology trends

Priorities and Challenges for Drone Companies in South Africa

Regarding the top market-driving factor for the South African drone market, there is a consensus that it is drone regulation. Despite any activity and participants’ reported slight improvement in regulation over the past year, the country does not rank high in the Drone Readiness Index, meaning that there is still necessary regulatory work that needs to be done for safe and scalable advanced drone operations. There have also been recent debates about whether the regulation is too restrictive and if it should be improved.

The second-ranked market-driving factor is understandably Drone Service Providers/Operators themselves. Their performance and reputation will help make or break the perception and success of drones in South Africa, at least according to the participants of this year’s survey. Lastly, Software Manufacturers were seen as the third leading factor, which potentially suggests there is a need for more software development in the country. This could entail more specific/sophisticated software, better software in general or perhaps simply even cheaper solutions.

What do drone companies in South Africa prioritize for the coming year? As in many countries throughout the world, the top priority is Marketing & Sales. This once again gives credence to the idea that product development has reached a point where it is reliable enough that companies can focus more on selling their products than on developing them. Considering that Software Development was ranked as the second-highest priority, it seems that indeed there is a need for improved software solutions within the South African drone market. The third priority for the future of South African drones is Finances & Funding.

South African Drones: Connecting the Industry

In comparison with the global average, the South African drone market is significantly more optimistic about the next 12 months (7.2 vs. 6.6). Moreover, this optimism also marks a substantial improvement from how drone companies in South Africa perceived the last 12 months (6.5). So, all things considered, the market has a shiny perspective about its future. This, however, does not mean that there are no concerns.

The main concerns reported by survey respondents were: 1. Regulation, 2. Funding, and 3. Domestic politics. Specifically, some respondents stated that “regulatory clarity” or the “slow pace of change and lack of enforcement of the regulations” were significant challenges on this front. So, the issue of regulation being a top factor in driving or stalling the market comes once again to the forefront. The second concern, Funding, also aligns with the third market priority. This reflects the continuing need for many parts of Africa to receive initial funding to get their products/operations going in various industries. The drone industry is no different in this regard, especially given the high costs often involved with robotics and investors’ hesitation to invest in SMEs in general.

Finally, the third concern reported was domestic politics. This has also appeared as a top 3 concern in places like the UK, Spain, and the DACH region, so it is certainly no outlier. Although there may be several reasons for this to appear as a top concern depending on the country (e.g. corruption, ineffective governance/legislation, etc.), the root cause can often be boiled down to competition. When companies or individuals focus on competing rather than collaborating, it can very often lead to “politicizing”, collusion, and unfair/preferential treatment that pushes members of a community into a tribe mentality that is detrimental to the community as a whole. But regardless of what the cause for this may be in South Africa, there are some encouraging signs ahead.

In 2024 and 2025, the African Drone Forum is planning to make a return, to bring together all members of the African community. Although it will not be limited to South Africa alone, there are also organizations like the African Institute of Entrepreneurship (AIFE, based in Johannesburg) that are helping push drone companies in South Africa into the spotlight. Therefore, the South African drone market and drone companies in Africa should be looking forward to stronger recognition of their activities and achievements within the global landscape

Stay tuned as we continue to feature more countries and regions with unique and exclusive data from our annual Drone Industry Survey. If you are interested in learning more about the global drone market, you can find detailed data by sector, industry, method, region, and country in our flagship Drone Market Report.

And if you are interested in all the ins and outs of a particular region or country, including information on individual companies, you can contact us to discuss a comprehensive drone market study. Please contact info@droneii.com with the subject “Customized Drone Market Research”.

Download our FREE Drone Companies in South Africa Infographic

Our Infographic about drone companies in South Africa shows a market breakdown of what drone companies do, their size, top priorities and challenges. It also features an optimism meter comparing drones in South Africa with the rest of the world.

Besides his financial oversight, Hendrik is an expert in aviation law and UAV regulation with more than 10 years of experience. Not only does he consult on all regulation questions, but Hendrik also writes the yearly drone investments report. Prior to launching DRONEII, at Lufthansa Technik he was the single point of contact to Civil Aviation Authorities (CAA) of Germany, Middle East and Asia.